Every business has to deal with invoices in some way. Even those that only offer intangible goods, like software or services. And while tracking a few invoices might be simple, things can quickly get overwhelming when those invoices pile up. This can leave you vulnerable to mistakes or even theft. One of the most popular and common solutions businesses use to shield themselves from these vulnerabilities is using 3-way match.

So, what is 3-way match? How does it help with verifying transactions? When should businesses use it? When should they use other processes?

What is 3-way match accounting?

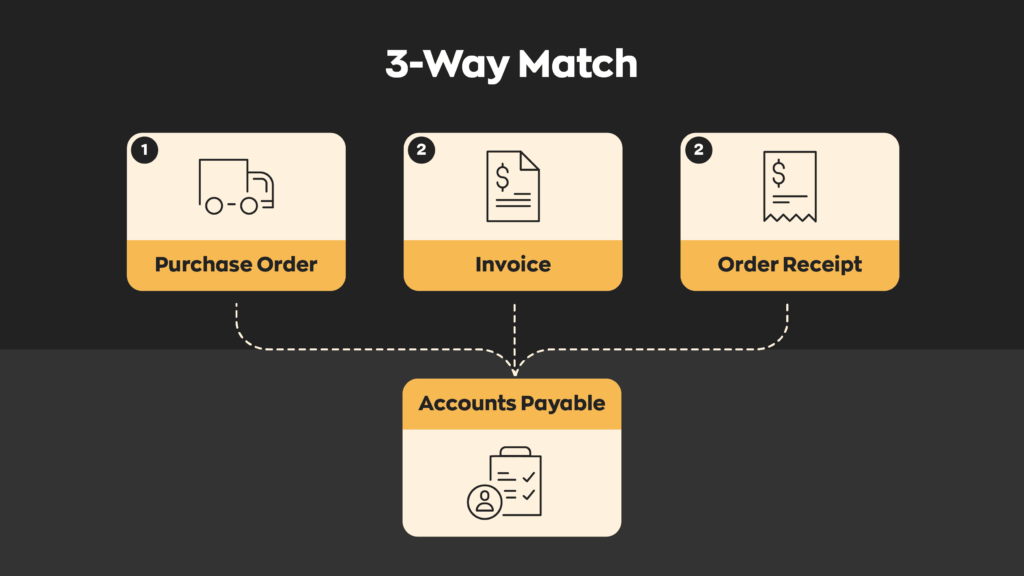

For businesses, 3-way matching in accounts payable is a method to verify the legitimacy of a transaction. This includes the accompanying payment. The process is called 3-way match because it involves matching the details of three different transactional documents.

The documents in question are:

- Purchase order (PO) – Before an invoice is issued, a buyer would make a request to procure goods or services from the seller. A purchase order is a document that outlines the specific items and/or services requested by a client, along with quantities, agreed-upon prices, and any terms and conditions.

- Invoice – Simply put, an invoice is a formal request for payment from the buyer to the seller. They should include information such as the products or services, costs, quantities, and applicable taxes or discounts.

- Order receipt – This document serves as a record of goods or services received by a company from a supplier or vendor. It plays a crucial role in ensuring accurate inventory management and verifying the delivery of products or completion of services.

If the details of all three documents match, the invoice will be approved, and the supplier will receive payment.

3-way match: an example

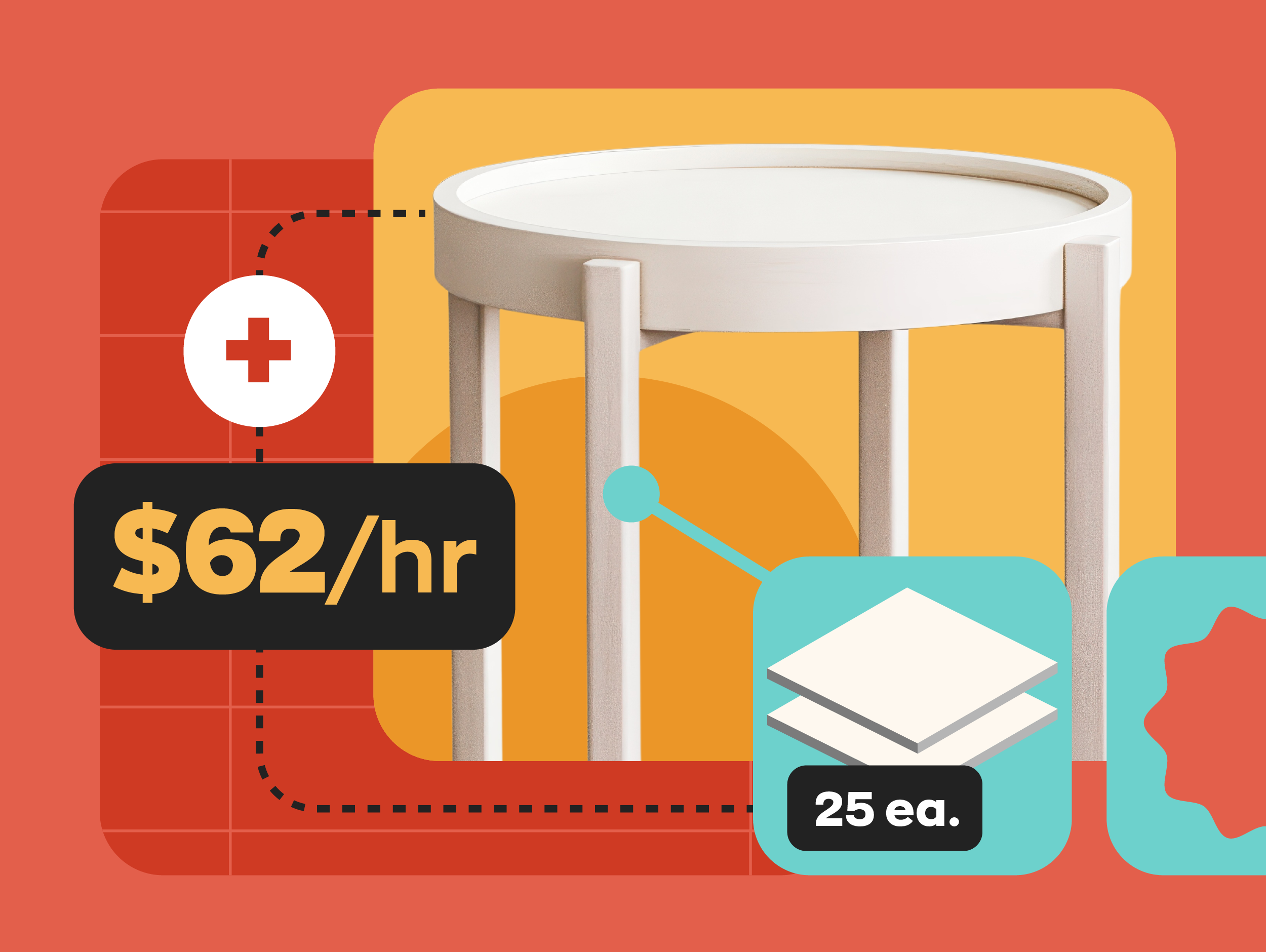

Let’s say there’s a retail shop for computer parts. The shop decides to place an order with their supplier for a new model of processors. Because each unit is expensive, any error could affect either party’s bottom line. In cases like these, the shop could consider implementing 3-way match. Here’s what the process would look like:

First, the retailer places an order with the supplier. As part of this process, a purchase order would be created. This purchase order includes the order size, price per unit (PPU), and expected arrival date.

For simplicity, let’s assume the supplier doesn’t manufacture the processors themselves. In this case, the supplier would fulfill the purchase order by simply picking, packing, and sending the processors to the retailer, along with an invoice.

Once the retailer has received the shipment and verified its accuracy, they’ll issue an order receipt. From there, the accounts payable (AP) department ensures the invoice details match the purchase order—things like the supplier’s name, order amount, and so on. Lastly, the AP department will cross-check the order receipt to ensure the shipment matches the purchase order and invoice as a last-step verification. After these three things are verified, accounts payable will process the invoice and release payment to the supplier.

And that’s it! That’s how the 3-way match process works. It might seem simple, but there’s a lot of events that take place behind the scenes. Some of them render 3-way match inefficient for specific businesses.

When shouldn’t you use 3-way matching?

Like most things, 3-way match accounting isn’t a one-size-fits-all solution. While it keeps things from slipping through the cracks, it’s also expensive and slow. Using 3-way match generally requires an AP department, which is a considerable expense in and of itself. Employees will also need training and likely software to smooth things out.

The back-and-forth nature of 3-way matching also slows things down tremendously. Sometimes, verifying information can take time, and contacting different departments adds to that time. This makes it impractical for fast-paced environments that value quantity over quality.

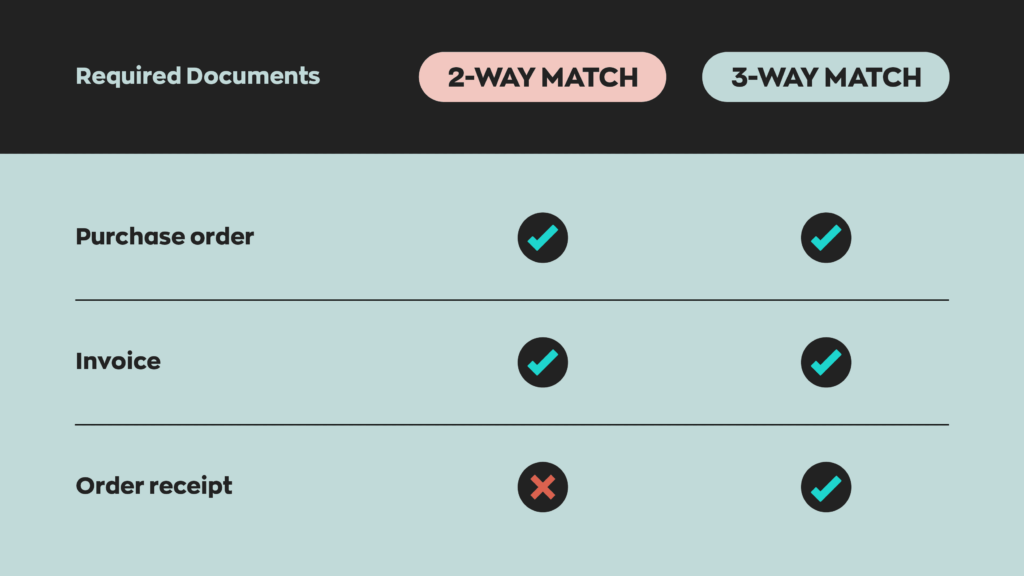

What is 2-way match vs 3-way match?

In 2-way matching, the accounts payable department only checks the PO and invoice for discrepancies. This lowers the burden of proof and allows regular operations to continue relatively undisturbed.

For small businesses that don’t deal with high ticket products or smaller volumes of orders, a 2-way match process could be enough to ensure accuracy without dedicating a lot of time.

One practice that’s becoming more and more popular is implementing hybrid procedures, such as setting a price threshold for when to use 3-way match vs 2-way match. This method provides the best of both worlds. Smaller transactions run without issue, but you can still protect the business against the risks of high-value transactions.

Should you always 3-way match?

In short: no.

We already partially addressed this, but some industries value speed over all else. In these industries, taking the time to verify everything could impact revenue. It’s best to use 3-way matching for items with high individual value, as losing a single unit incurs loss.

It’s also important to note that businesses also use 3-way match to reduce fraud. For reference, according to a study done by Verison, 34% of fraud cases in small businesses are internal/employee-related. Internal fraud cases can often be linked back to employees issuing fake invoices, and without a process like 3-way match in place, these invoices can easily slip through the cracks.

How inFlow can help with 3-way match

It is possible to perform 3-way match manually. In fact, many businesses still do it this way. However, it’s a really bad idea for several reasons. First and foremost, human error is constant, and computers are much more accurate. Secondly, 3-way match involves comparing a lot of numbers, which can be incredibly tedious and time-consuming.

An easy way to get around these issues is using software like inFlow that makes sales and invoicing easy. When AP is sent an invoice they can easily search the PO number in inFlow. From there, they can see the status of the order, whether it’s been received or partially received, and whether or not the invoice has been recorded as paid. On the desktop version of inFlow, we’ve even included the option to attach vendor invoices to POs to make finding everything super easy!

Wrapping up

As great as the 3-way match process is, it’s not suitable for every business or industry. In some extreme instances, it can negatively affect revenue; in others, it might cost more to implement and maintain.

While the rule of thumb is that high-value items are the target of 3-way match, there are outliers. Ultimately, it’s up to you to determine whether a 3-way match makes sense for your business.

0 Comments