How much you spend on inventory has a huge impact on your business. Luckily, knowing the right accounting formulas makes managing your costs a lot easier. Today, we’re looking at cost of goods sold (COGS), why it’s important, and the simple COGS formula.

What is cost of goods sold?

In simple terms, cost of goods sold refers to the cost of the inventory you have sold to customers. That’s the cost of the inventory to you, not the price the customer paid.

COGS usually takes into account all direct and indirect costs of a product. If you’re in manufacturing you would need to include things like materials and labor, for example. But other things such as shipping, custom duties, and any other overhead costs should also be included.

Cost of goods sold is sometimes referred to as “cost of sales”.

What’s the basic COGS formula?

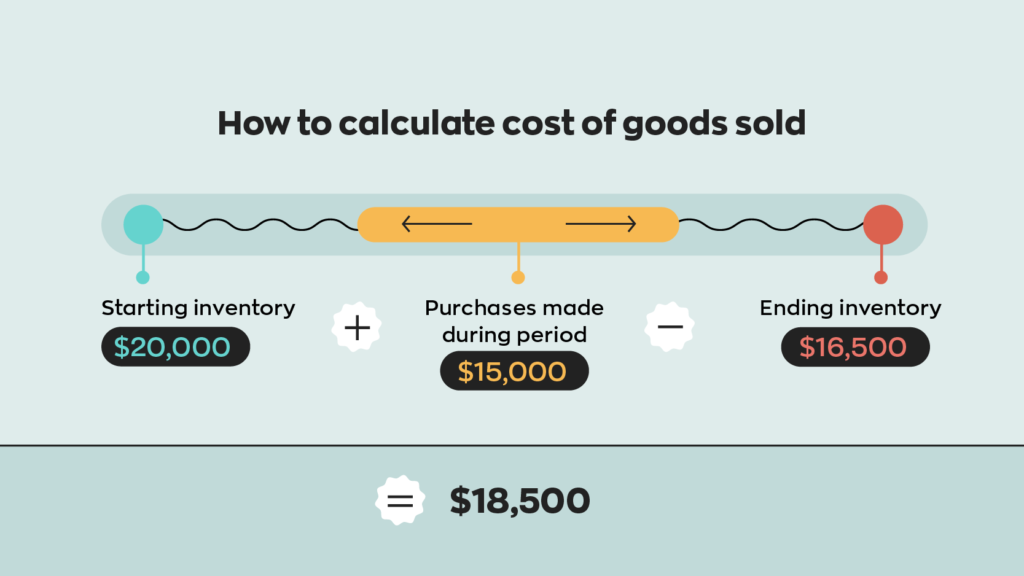

For retailers, to calculate your cost of goods sold, take the cost of your beginning (initial) inventory, add additional purchases, then subtract your ending inventory. This gives you the amount you spent on sold stock. As mentioned before, purchases include all direct and indirect spending.

Take a look at the cost of goods sold formula below:

(Beginning Inventory + Purchases) – Ending Inventory = Cost of Goods Sold

Manufacturers working out their cost of goods sold need to include factors such as raw materials and manufacturing costs in the formula. This may require additional calculations compared with the retail COGS formula.

A note about calculating inventory costs

There are several costing methods that you can use to manage your inventory, which can affect your COGS numbers. These include:

- FIFO – First in First Out

This method assumes that the items bought or manufactured first are also those sold first. So, when stock is sold, it is costed at the price of the earliest acquisitions.

- LIFO – Last in First Out

Here, it is assumed that the items which are bought or manufactured last are sold first. This means that sold items are costed at the price of the latest acquisitions. It’s important to note that this inventory valuation method is not accepted by the IFRS.

- Moving Average

Using moving averages means recalculating the average cost of units each time you purchase. The formula takes the total cost of the items purchased and divides it by the number of items in stock.

Not sure which method to choose? Take a look at our inventory calculation article, with handy examples.

Why is calculating cost of goods sold important?

There are several reasons why it’s important to calculate and understand COGS.

To turn a profit, the amount you spend on inventory needs to be below the amount you sell it for (amongst other factors, of course). Calculating your cost of goods sold means you know how much your sold inventory costs you in a given period. So, you can find your gross profit by subtracting that number from your revenue.

You can also use COGS to work out the rate that your stock is sold and replaced (inventory turnover). To do this, divide your cost of goods sold by your average inventory value. A low number will show you’re selling slowly and/or have too much inventory. A high number shows you sell products quickly, which is usually positive, but you could also be at risk of stockouts.

Business insights aside, COGS is generally considered an accounting expense, something that is tax deductible and needs to appear on your records.

Are there things you can do to reduce your COGS?

When thinking of how to improve profit, it’s easy to focus on increasing sales. However, the less your inventory costs you, the better your profit margins can be.

When reducing costs of any kind, the key is transparency. You need to see exactly what’s going on so you can get the right insights and make the right choices.

When it comes to cost of goods sold, this means understanding what exactly you’re paying and why. Otherwise, the decisions you make might not have the impact you were hoping for. For instance, you might choose to buy from a cheaper supplier, but later realize it compromises the quality of the product and affects sales.

Equally, buying a larger quantity of items might help you negotiate a better price. But if you decide to take this route, consider whether you have enough space and will sell the stock at a reasonable turnover rate.

It’s all about looking at what works for your business.

A note about cutting costs

Successfully cutting cost of goods sold might help you improve your profit margins, but the process doesn’t necessarily stop there. Keeping an eye on why you’re saving and what the money can do will help you plan for the future. As Deloitte explains, there are several reasons to strategically manage costs, including saving to:

- turn the business around

- fund actions that will help you take the competitive edge

- grow and stay scalable

- improve business operations and digital transformation.

How does inFlow handle costs of goods sold?

When an item enters your inventory through a purchase order or work order, its cost is calculated using the factors below. (We’ve included formulas here so you can see how it works, but luckily inFlow does the math!)

- Vendor unit price (including any discounts)

This number is shown on the unit price on the purchase order. To find the unit price yourself, just divide the product subtotal by the product quantity.

- Shipping fee/ freight

When you input a vendor’s shipping or freight fees, inFlow can take this number and distribute it across the stocked products on the purchase order. This distribution is weighted and is calculated as follows:

Unit Price ÷ [Sum of Stocked Products subtotal] * Freight Total = Freight (unit)

- Non-vendor costs

You may need to pay import fees, duties, or tariffs to someone other than your vendor. If so, you can record these in the non-vendor cost field.

Unit Price ÷ [Sum of Stocked Products subtotal * [Non-vendor Cost % * Order Subtotal] = Non-vendor cost (unit)

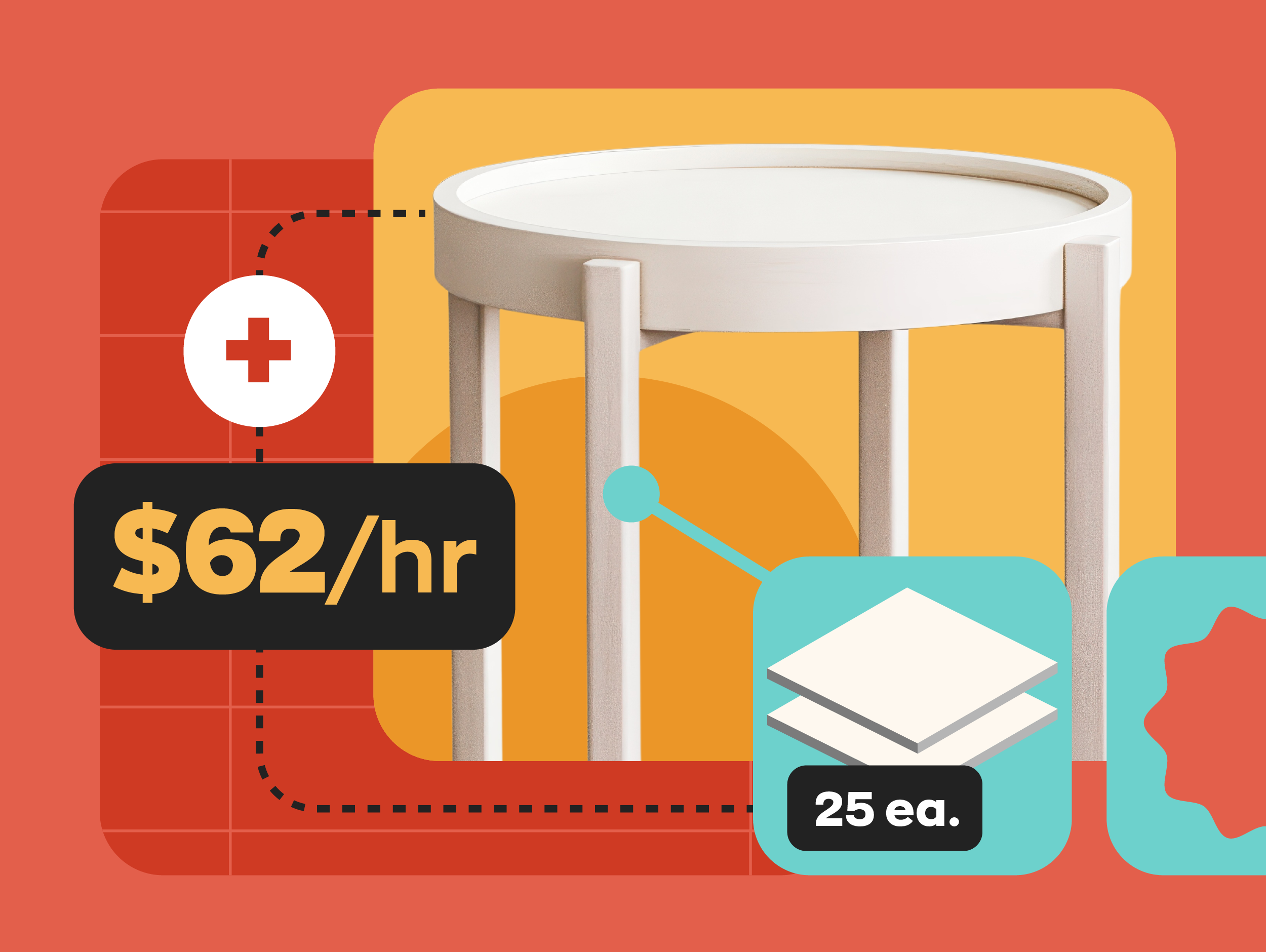

- Service items on the purchase order

Sometimes, you’ll need to pay a separate service fee to your vendor (for example, for engraving). This can be added to the purchase order as a service-type item. However, the fee will be then added to all items on an order, so you might need to make separate orders for items that include the fee.

[Unit Price ÷ Sum of Stocked Products subtotal] * Service Total = Service cost (unit)

- Cost of component items (work orders)

If you’re using work orders (on one of our select plans), the cost of components may need to be included. You can find out more about using work orders on our support page.

inFlow does not include any taxes on the purchase order in cost calculations.

Having the right tools makes calculating costs, managing inventory, and gaining insights much simpler. Take a look at how inFlow makes things easy with our all-in-one platform.

0 Comments