The ultimate goal of any business that sells products is to incentivize customers to spend more at checkout. This is why the average order value (AOV) is a valuable metric for businesses looking to grow. AOV helps you strategize pricing, marketing, and sales efforts. You can even use average order value to improve your demand forecasting.

So today, we’ll get into the nitty-gritty of what is AOV and why it’s such a useful metric. We’ll explore how to easily calculate your business’s average order value, the benefits of knowing your AOV, and some proven strategies to help improve your average order value.

What is AOV?

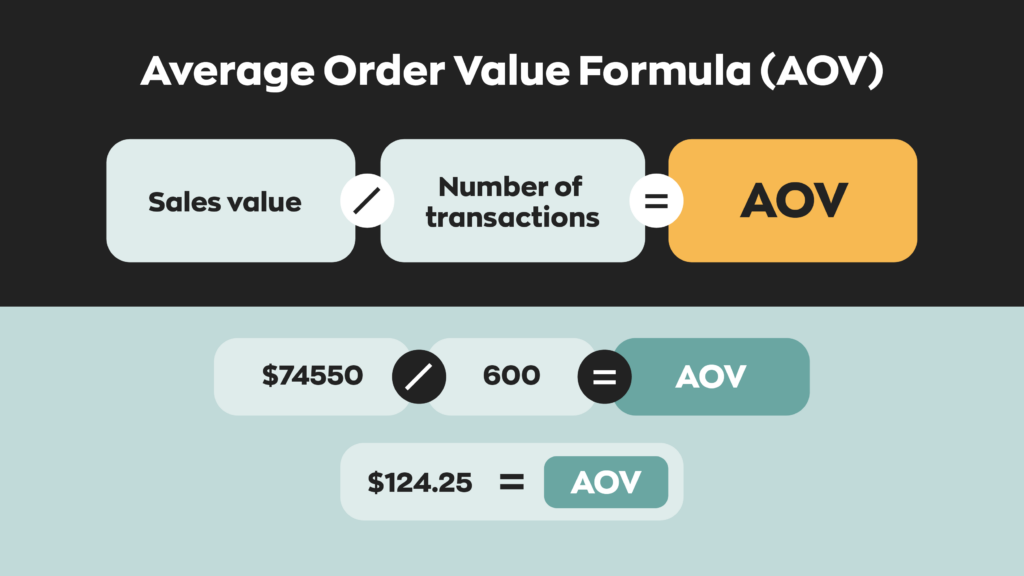

The AOV meaning is simple: it’s the average number of sales a business makes per transaction. Calculating average order value is simple: divide the total sales value by the number of transactions. For example, let’s say that a business sells $74,550 worth of products in September. We’ll also say that it took 600 transactions to achieve this sales figure.

Only two figures are necessary for the average order value equation, which looks like this:

Therefore, the business’s average order value for September would be $124.25.

Why is average order value important?

AOV is a helpful figure in a lot of ways. One of which is sales forecasting. While not 100% accurate, looking at your historic average order value for specific months can give you a good idea of what demand will be for the current year.

Businesses can also use the average order value to measure how well marketing efforts and pricing strategies are working so they can take action to increase their AOV. Many small businesses find that increasing their AOV is a cost-effective way to improve their margins. What do we mean by this?

Well, it’s best to think of your sales in two stages. The first stage is increasing traffic. Typically, businesses try to increase traffic to their retail front through a number of means. For ecommerce stores, this can be ad campaigns, and brick-and-mortar stores might rent out nearby billboards.

The second stage is actually making the sale. It’s your business’s responsibility to make your products attractive to customers. You can accomplish this through quality, prices, or a combination of multiple different factors.

The distinction is that improving traffic incurs costs, but making sales doesn’t. As a result, it can be more lucrative to focus less on growing traffic and more on increasing your average order value.

What are the downsides of AOV?

Average order value has a fatal flaw: it homogenizes data into a single figure. Sometimes, it’s helpful to compress data into a single figure, but increasing sales isn’t that simple. It depends on various factors, ranging from product quality to the time of year.

It’s also worth noting that regarding sales forecasting, AOV’s usefulness tends to drop as products become more varied. Because the data point itself erases everything else about the sale except for the value, as product variation rises, relying too heavily on it can sometimes be fatal.

To be clear, however, AOV is still a very useful figure. It’s simple, easy to calculate, and can offer insights at a glance. The key takeaway here is that you should never rely solely on average order value. It’s just one of many figures to consider when making big business decisions.

What other metrics are there to consider?

Realistically, it’s best to consider as many data points as possible. There’s a lot, though, so here are some of the most important ones.

- Conversion rate: Your conversion rate is the number of people who purchase out of those who visit. It’s a bit more complex because it considers the number of web sessions, but it’s arguably the most important metric.

- Lifetime customer revenue: This metric is an estimation of how much a business can expect a customer to spend over the course of the business relationship. This takes into account the expected lifetime of the business.

- Customer acquisition cost: This handy metric calculates how much it costs to attract a customer’s business. Businesses calculate this figure alongside marketing campaigns to get as accurate a figure as possible.

- Returning customer rate: The number of customers who make more than a single purchase is known as the returning customer rate. This is a good indicator of product relevancy.

How can I increase my average order value?

There’s a lot of ways to increase AOV, but it generally comes down to one of two things. Adding extra value for the customer or incentivizing more purchases through careful product placement. Here’s some proven ways to increase your average order value.

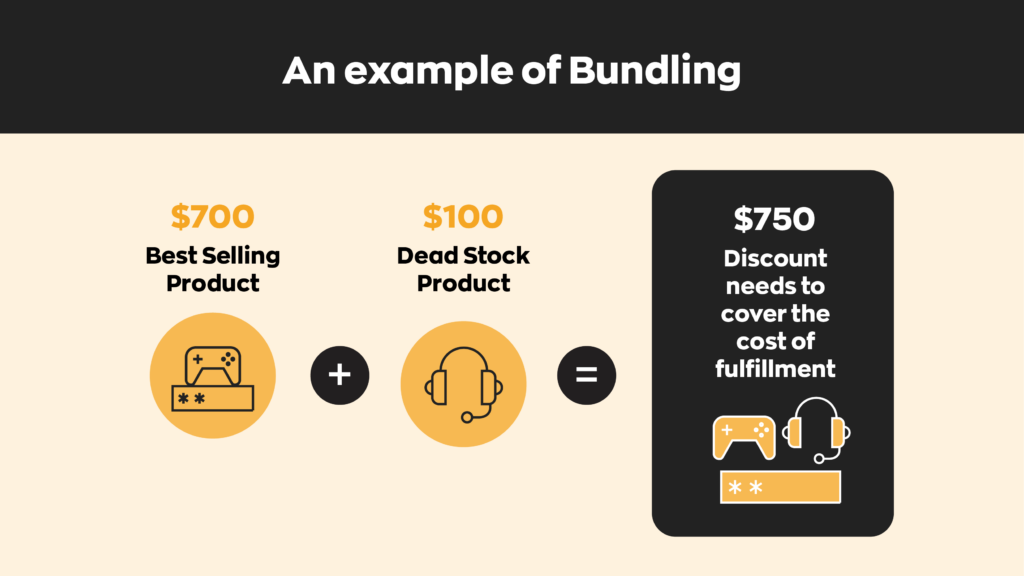

Bundle items together

Grouping products for sale is known as kitting/bundling, and it’s been around for decades. Think gift baskets, for example. Offering products that complement each other is a great way to persuade your existing customers to purchase items they may not have purchased otherwise. For instance, if someone buys a new computer, they’re more likely to purchase an accessory like a mouse. So why not bundle those two items together?

Implement a price threshold for free shipping

Let’s say your current average order value is $30. An easy way to increase it is by offering free shipping just barely above that threshold. For example, $35. If customers have the ability to save $10 or more on shipping, they have an incentive to spend the extra $5 to hit the threshold.

Create a customer loyalty program

One good way to keep customers coming back is to offer rewards for repeat business. These reward programs can also increase your average order value through promotional offers. Setting spending thresholds for customers to earn extra rewards could encourage them to put those additional items in their basket.

Upselling at checkout

What do overpriced candy bars, packs of gum, and the iconic phrase “Do you want fries with that?” have in common? Well, they’re all examples of upselling. For example, placing products near checkout to try and increase sales is a tactic that brick-and-mortar retailers have used for ages. Today, we’re seeing ecommerce stores doing the same by showing shoppers items often purchased with the product in their cart. The idea is to offer your customers something they didn’t even know they needed.

How can I calculate my average order value more easily?

Average order value itself is easy enough to calculate. The trouble comes when trying to gather all the necessary data. If you’re tracking your sales and purchases using a pen and paper, you’ll have your work cut out for you.

The good news is that there are easier ways to track your sales and purchases without spending hours reviewing countless spreadsheets or paper documents. Our software inFlow was designed with small business owners like you in mind. We have various features for tracking inventory, sales, and purchases. The best part is that our robust reports give you all the metrics you need to calculate your average order value easily, as well as other valuable metrics.

What else does inFlow offer? We also have a built-in barcoding system that makes receiving, picking, packing, and shipping super easy. And if you’re running an ecommerce business, you’ll be happy to know we have integrations with Shopify, Woocommerce, Amazon, and more!

0 Comments