Even if you lead an ordinary day-to-day life, there’s a good chance you’ve had to sign a waiver at some point. There’s good reason for this: if you receive an injury on company premises, they can be held liable. If you’re working in the construction industry, a common type of waiver you will utilize is a construction lien waiver.

It shouldn’t be surprising to hear that construction companies regularly use waivers. In fact, a construction lien waiver is one of the most important documents these companies use. So: what is a lien waiver? What parties does it protect? What stipulations should your construction lien waiver include?

Before we dig in, though, there’s something we need to make clear: these are legal documents. While we’re confident in our ability to explain these documents and their purpose, the relevant legislation may differ. inFlow is not responsible for any situations that may arise due to a lack of proper research.

What is a construction lien waiver?

If you Google the word lien, you’ll see something along the lines of “the right to keep another’s property until a debt they owe you has been paid.” In legal terms, this is a way of ensuring that someone repays their debt.

For example, let’s say that you take out a loan to purchase a home. While you own your home, you still owe the bank money. The bank may place a lien on the home to prevent you from selling it before you pay off the mortgage. This doesn’t translate exactly to the construction industry, but it gives the basic idea.

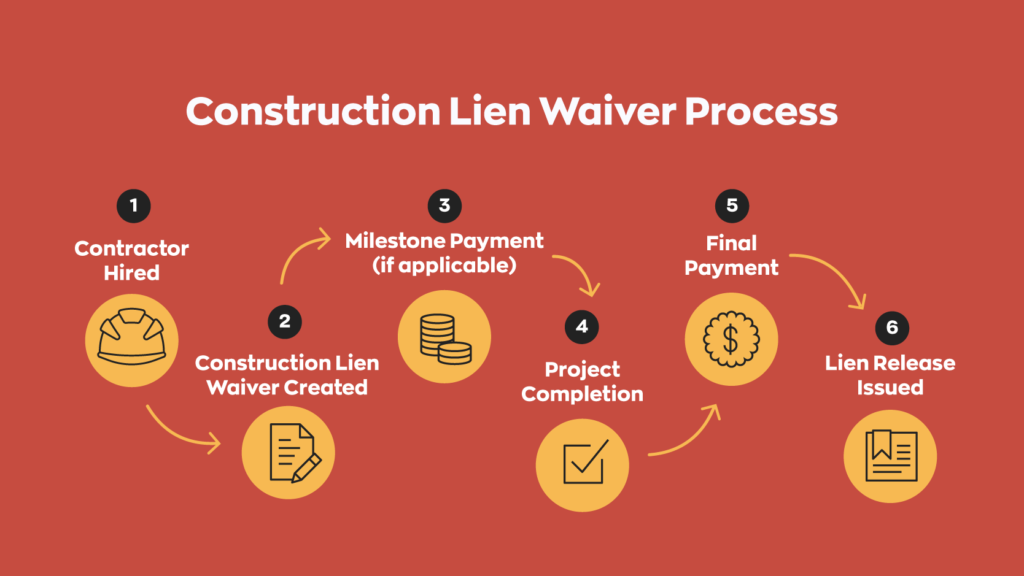

In broad terms, when a contractor signs a lien waiver, they give up any claim to ownership once the project reaches completion.

You can think of a construction lien waiver as something similar to a cost-plus contract. Contractors use cost-plus contracts to protect themselves, and employers use lien waivers to protect themselves.

Why are construction lien waivers important?

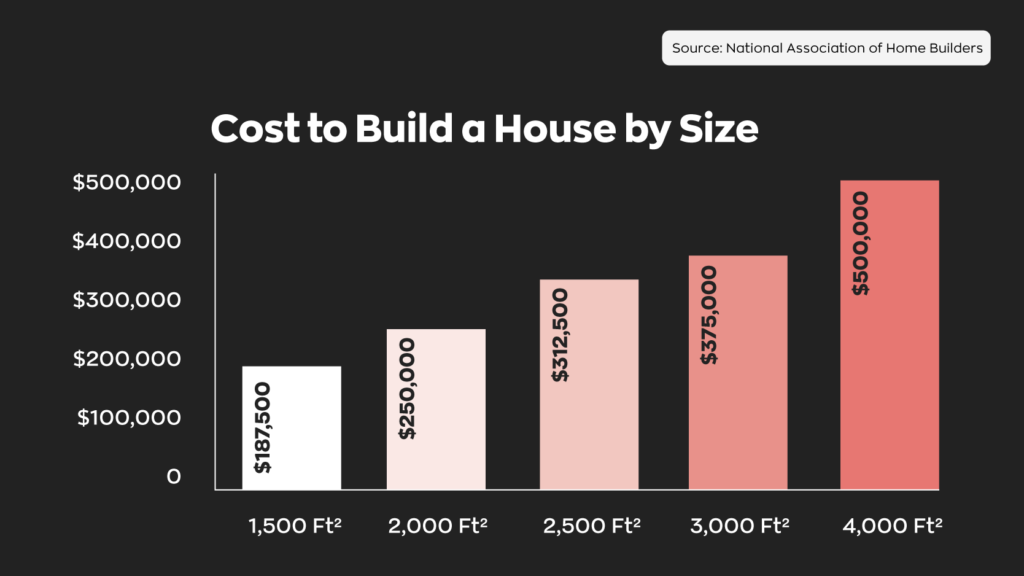

Some construction projects can get expensive. For example, experts say the average apartment project costs anywhere from $150-$400 per square foot. While that is a lot of variance (and a lot of money!), these projects pay themselves off over time and eventually turn a profit. The basic idea behind many construction projects is an upfront cost for gradual, long-term profit.

In the past, though, there have been instances where contractors lay claim to the project once it reaches completion. This can be for a variety of reasons. Complications on long-term projects are common. They could result in an extended timeframe, more expensive materials, and so on. In some other cases, unfortunately, human greed plays a part.

These sorts of cases almost invariably lead to lawsuits. Not only are lawsuits expensive, they can also drag on for years. Because the building’s ownership is unclear, no one can occupy it during this time. Additionally, because the project takes up space, there’s bound to be some taxes to pay. All of this adds more expenses to an already expensive project and delays the return on investment.

Are there different types of construction lien waivers?

Generally speaking, there are four types of construction lien waivers.

- Unconditional waiver and release upon final payment – This waiver stipulates that the contractor releases all rights to ownership once they receive their final payment.

- Unconditional waiver and release upon progress payment – This waiver states that the contractor releases all ownership rights by a specific date. Unlike the previous waiver, there are no additional stipulations.

- Conditional waiver and release upon progress payment – Under this waiver, the contractor gives up any claim to ownership by a specific date. Unlike this waiver’s unconditional counterpart, this waiver only becomes valid once all payments have been received and verified.

- Conditional waiver and release upon final payment – This waiver states that the contractor releases all claims to the project once they receive final payment and certain agreed upon stipulations are met.

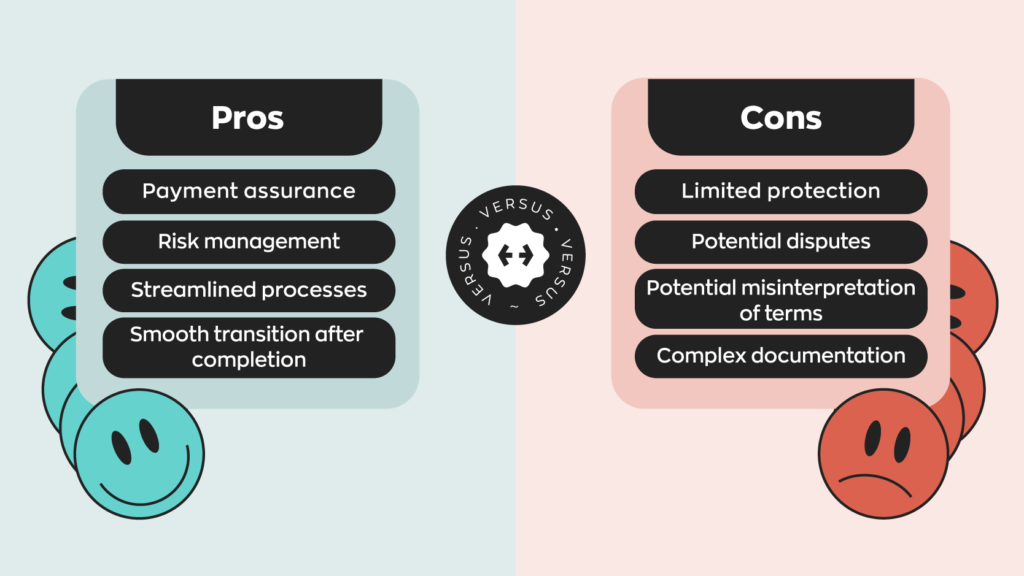

It’s worth noting that while these waivers seem to protect only the employer, they do offer some protection to contractors. They ensure that workers receive their pay and provide a legal path forward in case anything happens.

When should you use a construction lien waiver?

Using a contractor lien waiver every time might be tempting, but sometimes it’s simply not worth it. Construction is the focus of this post, but there’s plenty of other contractors out there as well. For example, you wouldn’t make a home plumber sign a lien waiver because they can’t place a lien.

Generally speaking, concerned parties use construction lien waivers for expensive, large-scale projects they all have a stake in. Contractors may not have a claim to ownership, but the receipt of their payment relies on the project’s success. As such, these lien waivers are essential in protecting all parties.

Are lien waivers and lien releases the same thing?

To put it simply, no. While related, they are different documents. As mentioned above, a lien is a legal document that ensures someone repays their debt. A lien release is filed once the debt has been fulfilled or every party reaches an agreement. Essentially, a lien release indicates the lien is no longer in effect.

Tips and tricks for keeping track of things

Construction lien waivers can be long. They’re also common, which means they tend to pile up over time. Here’s some tricks that might help you keep track of things.

- Minimize reliance on paper. Even if the world runs on paperwork, most of that paperwork is digital now. It’s faster, easier, and anyone can access it from anywhere.

- Attach relevant documents. Having a visual aid of some sort can make organizing and keeping track of things much more manageable. “Relevant documents” include things like invoices, emails, and other correspondence.

- Use spreadsheet tracking software. Sometimes spreadsheets are just the right thing. In this case, though it makes organization easier, the sheets can become huge. Using software or even a simple add-on can make keeping track of things much more accessible.

It also pays to stay organized in other areas of your work as well. If files (or worse, equipment) go missing or someone misplaces them, that can throw everything off. Contractors could end up at the wrong location or be unable to work. This can cause a ripple effect that forces you to update your waivers en masse– and could cost you. Field management software is an excellent way to stay on top of things. It’ll help you keep an eye on everything and can automate menial tasks while doing so.

Field service management software also makes tracking resource consumption a breeze. This makes tracking your cost of goods sold quick and easy and will ensure you stay within budget.

Parting words

It’s essential to keep in mind that legislation can differ wildly depending on your location. International law is the most obvious, but even on the state or province level, things might be different. When dealing with legal documents of this nature, it’s crucial that you research the legislation relevant to you. Otherwise, you might have the rug pulled out from under you, so talking with an expert is never a bad idea.

0 Comments