Key takeaways

- Cost of goods manufactured (COGM) represents the total cost of manufacturing goods within a period of time. It accounts only for direct costs such as materials, labor, and manufacturing overhead.

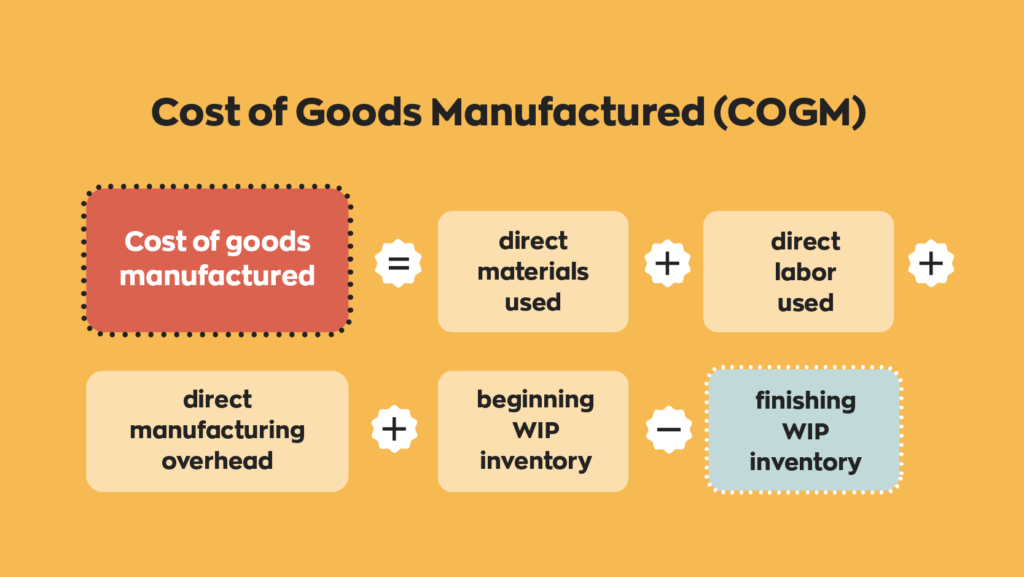

- The cost of goods manufactured formula is: COGM = Direct Materials Used + Direct Labor Used + Direct Manufacturing Overhead + Beginning WIP Inventory − Ending WIP Inventory

- Beginning and ending work-in-progress (WIP) inventory are crucial components that represent the value of incomplete products at the start and end of the period.

- Direct materials, direct labor, and direct manufacturing overhead are calculated based on the cost per unit, labor hours, and production-related overheads.

- Understanding COGM helps businesses set optimal prices and plan budgets, enabling better inventory and cost control.

Staying in the know is an important part of manufacturing. As simple as that sounds, it can be pretty tricky. The cost of manufacturing is never just the cost of components. There are labor costs, overhead costs, and so on. So: what is the cost of goods manufactured formula (COGM)? Where does it fit in? How does it relate to total manufacturing cost? And how do you calculate the cost of goods manufactured?

As a side note, before we begin, it’s a good idea to read our post about types of inventory. We’ll be using some terms like work-in-progress (WIP) inventory and finished goods, so if you want a better understanding of these topics, consider giving it a read.

For now, though, keep in mind that WIP inventory refers to products that have yet to complete the production cycle and are not ready to be sold to customers.

If you like the formula in this article or formulas in general, you’re going to love our Inventory Formula Cheat Sheet! We put together 7 of the most commonly used formulas for inventory management in this handy document for anyone to download.

Download your inventory cheat sheet now!

What is the cost of goods manufactured?

Cost of goods manufactured (COGM) is an accounting term that refers to the cost of manufacturing products during a specific period. This sounds similar to total manufacturing cost– and it is– but COGM only includes direct costs. So you wouldn’t include things like utilities and other overhead costs in these calculations.

The cost of goods manufactured formula is often confused with the cost of goods sold formula, but these two formulas differ. We’ll get into more detail about this below.

What is the cost of goods manufactured formula?

Like many other business concepts, the best way to explain the cost of goods manufactured is through a basic math equation. In this case, that math equation is as follows:

It seems simple, but you’ll need to understand these terms to make use of the formula. The vital thing to note here is that these inputs are strictly part of the manufacturing process, unlike total manufacturing cost, which considers pretty much everything.

You may also see the following equation:

COGM = beginning WIP inventory + total manufacturing cost – ending WIP inventory.

Both of these equations are the same. The difference is the first equation has just broken down the “total manufacturing cost” portion of the equation into its components. It also helps avoid confusion, as “cost of goods manufactured” and “total manufacturing cost” are, in fact, different.

Calculating WIP inventory

It’s easier to show rather than tell, so let’s pretend you run a bakery. We’ll start with beginning and finishing WIP inventory since it’s unclear what those terms mean at first glance.

Let’s also pretend that you have 300 pastries that you have yet to complete and that these pastries sell for $3 each. If you were to begin calculating cost of goods manufactured now, your beginning WIP would be $900.

Now let’s pretend that within 30 days, your bakery finishes 150 of these WIP pastries. That leaves your ending WIP inventory at 150 units, making your ending WIP inventory $450.

Calculating direct materials and direct labor

Direct materials and direct labor are more straightforward. In our example it costs 30 cents to manufacture a single pastry. If you multiply the number of pastries made (150 in this example) by the material cost, it would look like this:

150 x .3 = 45.

So, for this example, the cost of direct materials would be $45.

Direct labor is similar. Multiply the number of employees by hours worked, then again by their hourly rate. For this example, let’s pretend it takes 10 employees 3 hours each to make those 150 cupcakes. Let’s also pretend that their hourly pay is $15. It ends up looking like this:

10x3x15= 450.

In this case, the cost of direct labor is $450.

Calculating direct manufacturing overhead

Direct manufacturing overhead is trickier to figure out. For the COGM, you should only consider overhead costs that directly contribute to product production. This can include the cost of using specialized equipment and so on.

It can get tricky when you calculate manufacturing overhead, and every business is different, so they will have other variables to consider. So, for the sake of simplicity, we’ll assume that our direct manufacturing overhead is $200.

How to calculate the cost of goods manufactured?

Now that we have all our numbers, let’s plug them into the cost of goods manufactured formula. We’ll be using the longer version of the formula listed above.

$1145 (COGM) = $45 (direct materials used) + $450 (direct labor used) + $200 (direct manufacturing overhead) + $900 (beginning WIP inventory) – $450 (finishing WIP inventory)

When we input the numbers in this example into the cost of goods manufactured formula, we get $1145. Of course, this is just an arbitrary example, and your cost of manufactured goods will be quite different based on several factors. Once you know your cost of goods manufactured, you can price your products however you like to ensure you’re always making your desired profit.

Why is it important to know your cost of goods manufactured?

Businesses run on many things—time, money, inventory, supply lines, opportunity, and so on. The one thing that all of these things have in common is that they’re all finite. There’s only so much time and money available, so it’s essential to use all of it as efficiently as possible.

This is why information is so important. Not just in the day-to-day operations but for long-term plans as well. This is especially important in the manufacturing business, where there are significantly more factors to consider.

This is where cost of goods manufactured can help you figure out where to cut corners. It can help save warehouse space, make your manufacturing process more efficient, and develop better pricing strategies. In turn, businesses can reallocate the resources they save.

What about cost of goods sold?

Another similar phrase to cost of goods manufactured is cost of goods sold. Given their names, it’s probably not surprising that they refer to similar things. Just like with total manufacturing cost, though, there is an important distinction.

COGM only refers to expenses incurred directly during manufacturing. Cost of goods sold, as the name implies, includes any costs you incur in order to sell the product. Generally, this would consist of indirect expenses such as marketing and administration costs.

How can inFlow help?

Generally, calculating the COGM yields information that will be useful to your business. At the same time, calculating the CGOM requires you to already have a ton of information on hand.

On top of knowing the in-and-outs of your manufacturing process, you’ll need to understand how your supply lines work, what materials you have on hand, and so on. It might not be difficult to gather this information, but it does take time. And collecting that information comes at an opportunity cost.

This is a significant factor behind the rising popularity of inventory management software. On top of keeping track of your inventory, inFlow gathers information on the ins and outs of your manufacturing process, making it easy to tell what’s what at a glance.

0 Comments