Key takeaways

- Gross profit margin is what % of each sale is profitable.

- The gross profit margin formula is: gross profit margin = Net sales – COGS / Net sales

- A business can use it with other KPIs to indicate financial health.

- It differs from gross profit.

Maintaining healthy long-term cash flow is crucial for any business. But, there are a lot of factors that go into determining revenue, and there are a lot of indicators that organizations look at when assessing health. One of these indicators, of course, is gross profit margin.

At a glance, this metric tells a business how much they earn on each sale. Over longer periods, it serves as a valuable indicator of business health. However, like many business metrics, there’s often confusion surrounding gross profit margin.

So, today, we’ll go over what it means for your business and what factors affect it. We’ll also touch on some similar terms and give you some common strategies you can use to increase your overall profit.

What is gross profit margin?

This popular metric is a financial figure that companies use to analyze their financial health. It refers to leftover profit after accounting for cost of goods sold (COGS). In essence, it shows how much money a business makes after accounting for its operating expenses.

Gross profit margin vs gross profit

An important note here is that gross profit margin vs. gross profit are not the same thing, despite the similarities. Gross profit margin is expressed as a percentage of total sales, while gross profit is the sum of total profits and is expressed as a dollar value.

What is a good gross profit margin?

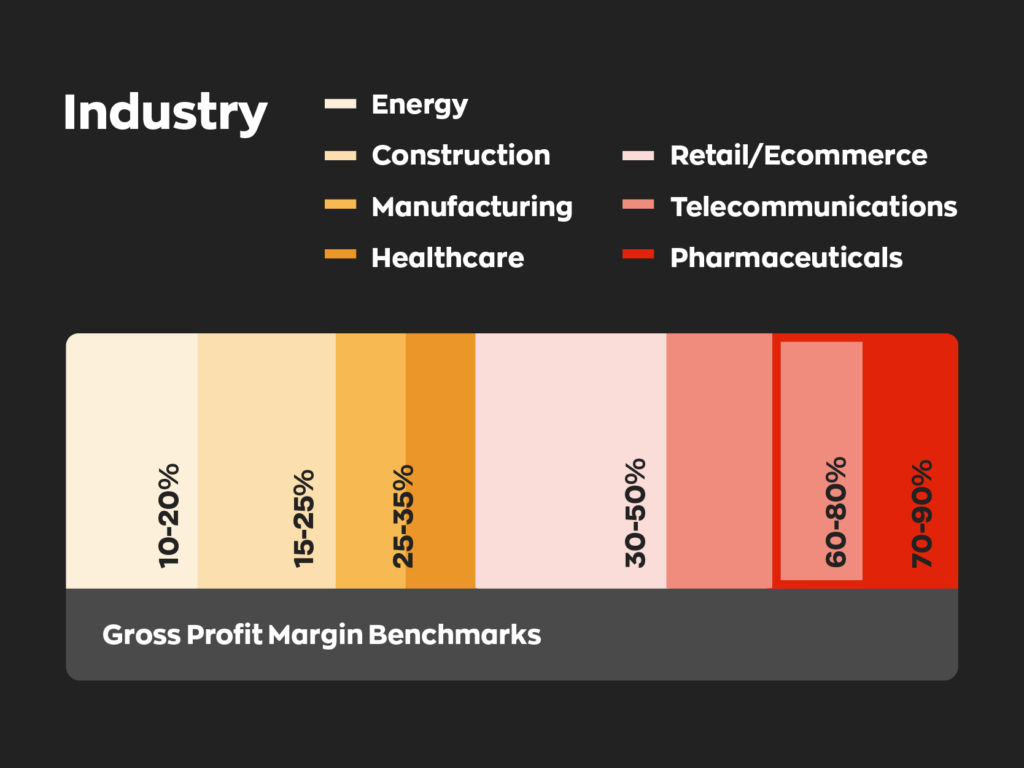

A “good” margin varies depending on your industry. For example, retail and food services consider 20-40% as good, while manufacturing companies use 25-35% as a benchmark.

Generally, any number above 10% is acceptable, while 20% to 30% is considered good, depending on the industry. For high-margin industries, anything above 50% is often seen as excellent. Very few industries will see margins this high.

How to use the gross profit margin formula

Here’s how to calculate gross profit margin using the gross profit margin formula.

Generally, you should be aware of your businesses’ COGS and net sales already. They’re vital figures to keep track of and contribute to calculating other useful health indicators as well.

For this example, we’ll pretend that the net sales and COGS are $275,000 and $200,000, respectively. Do note that figures usually aren’t so clean. This is just for the sake of example. Once we plug the figures in, this is what it looks like:

Gross profit margin (GPM) = 275,000 – 200000 / 275,000

Now, we can solve to figure out the final margin.

GPM = 75000 / 275,000

GPM = 0.27 or 27%

How does gross profit margin impact your business decisions?

To be clear, making decisions based solely on a single data point is a bad idea. It’s very rare for one indicator to tell the whole story. It’s just as important to know what contributes to the final figure because, as we mentioned earlier, gross profit margins can vary depending on your industry.

For example, let’s say your business has a gross profit margin of 12%—a little on the low end, but nothing too out of the ordinary. You could leave things as-is and be perfectly fine, but there might be an issue hiding behind that 12%.

One product, for example, might be selling exceptionally slow, while another you can barely keep stocked. In these instances, it could be worth selling the slow-moving product at a lower cost and replacing it. Cases like these are common, and looking at just gross profit margin doesn’t tell the whole story.

However, it’s also true that it’s a very valuable figure. While it doesn’t tell the whole story, it does give you a great bird’s eye view of your overall business success. Because we express gross profit margin as a percentage, it also tells us how much a business makes on each dollar.

1% means 1 cent every dollar, 5% means 5 cents, 25% means 25 cents, and so on.

If your margin suddenly dips, that’s a good indicator that there’s something wrong, internally or externally. Here are some common factors that affect the final figure.

Cost of goods sold

Your cost of goods sold reflects how well your business operates and how well it reduces its overall operating costs. The lower your COGS, the higher the margin. When calculating gross profit margin, it’s important to have accurate numbers for your cost of goods sold.

Pricing strategies

Pricing products based on the overall landscape is usually a good idea, but no matter what you decide, it’ll have side effects. For instance, a higher sale price means more profit but a greater chance of getting undercut by your competition, which means lower sales. Pricing products lower will mean less profit, but you’re likely to bring in more sales. Be sure to find the balance that works best for your business.

Inventory management

Believe it or not, inventory management is crucial to a company’s margin. The route products take from purchase to sale significantly impacts their COGS. By extension, it affects gross profit margin. Losing or delaying shipments lowers revenue, and optimizing routes and processes is crucial to long-term success.

Global affairs

Sometimes, things just happen. The year 2020 brought us a lot of things, and it also taught us a lot about business operations. While COVID is now largely in the rearview, its effects continue to linger, and most are simply beyond control.

Best practices for improving gross profit margin

Increasing your gross profit margin is usually a slow process. It requires an overall reflection on your business operations, so while small changes will have an effect eventually, it will take time to show progress.

Something worth noting here is that focusing on one aspect impacting your profit margin will cause the others to suffer. It’s best to hone in on several areas with the biggest impact on your bottom line and improve them simultaneously.

This means not just raising prices or increasing sales but also identifying deadstock and lowering operating costs. You’ve probably heard, “a penny saved is a penny earned,” and it applies here pretty well. Lowering operating costs might not be as grand as increasing sales, but it also increases profit margins.

Lower COGS

We already went over COGS, but it’s worth rehashing. The COGS ultimately dictates how much profit is left after a sale. Lower COGS and increase profit. You can improve your COGS by reducing waste, optimizing stock levels, and negotiating better supplier terms.

Lower operating costs

Operating costs aren’t part of COGS but are another factor at play. Employees need their wages, warehouse owners need their rent, leases, and taxes need to be paid, and so on. These costs also eat into your bottom line, so lowering them where possible will increase the gross profit margin.

Upsell

Selling existing products at a higher price can be a simple way to increase margins. However, product pricing is ultimately decided by consumer demand, so this requires lots of market insight.

Purchase at scale

For products that sell year-round, buying in bulk can sometimes be best. The rule of thumb is that the more you buy, the less it costs per unit. If you can take advantage of this ahead of time– and can afford upfront costs– purchasing at scale can substantially increase margins.

How inventory software can help increase your gross profit margin

Every business’s goal is to achieve the best possible gross profit margin, but achieving that goal can be daunting. However, adopting modern software solutions is a simple way to get the most bang for your buck.

Our inventory management software, inFlow, can help you improve your gross profit margin in several ways, including:

Optimizing your inventory management might not solve all your problems, but it’ll make a world of difference.

0 Comments