Key takeaways

- Margin vs markup: markup is the amount added to a product’s cost to determine its selling price, while margin represents the profit as a percentage of the selling price.

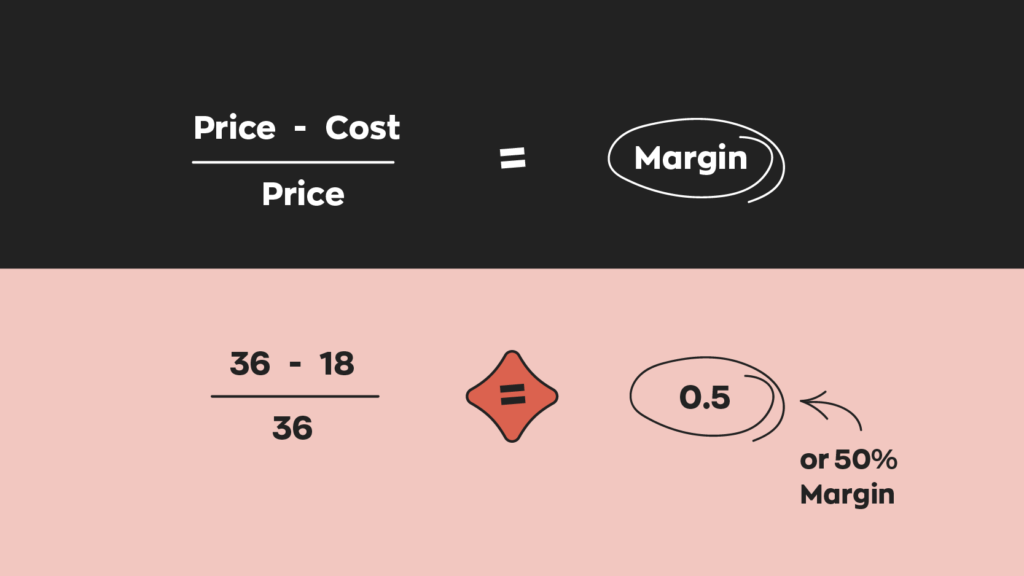

- The margin formula is: Margin = (Selling Price – Cost) / Selling Price

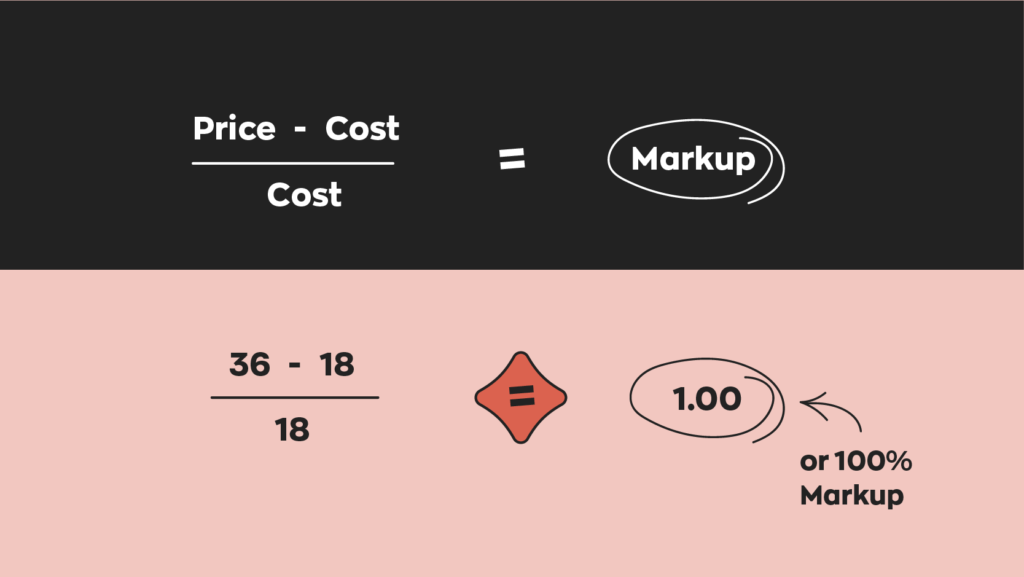

- The markup formula is: Markup = (Selling Price – Cost) / Cost

- A 50% margin corresponds to a 100% markup. Understanding this relationship is vital for businesses when applying appropriate pricing strategies.

- When making the choice between margin vs markup, businesses should select the method that aligns with their pricing objectives to ensure profitability.

How do you calculate margin vs. markup — and what’s the difference between the two? It starts with figuring out your product’s cost. From there, you can decide on how to price it. Figuring out your product’s cost will depend on several factors. For example, whether or not you buy in bulk, source your products from different vendors for different prices, and so on. Once you calculate your cost of goods sold (COGS), you can use your cost to calculate your price.

This is where the concept of markup comes in. Depending on where you search, you can get different answers for what markup is and what it has to do with something called margin (or gross profit margin).

Let’s start with a quick overview:

- Markup is the amount by which the cost of a product is increased in order to obtain the selling price. For example, a markup of $90 on a product that costs $110 would give a selling price of $200. Which is an 82% markup (markup divided by product cost)

- Margin is the selling price of a product minus the cost of goods. Using the above example, the margin for a product sold for $200 with a cost of $110 would be $90. Which is a 45% margin (margin divided by the selling price).

If you’re wondering how to untangle that web of M-words, you’ve come to the right place.

Let’s get into it!

Calculate margin vs. markup in video

If you’re one of the millions of people who prefer to learn through the magic of video, we’ve got you covered! Here is a video that explains how to calculate margin and markup.

If you’d like a step-by-step breakdown of the formulas, read on!

Calculating the cost of your products

If you’re already confident you know your product’s cost, skip this section and head straight to the formula; if not, read on!

In order to understand how to calculate margin or markup, it’s integral that you know exactly what your product costs. The cost of any product is more than just what you pay for it. As mentioned above, several factors will add to the cost of a product. Some of these factors include:

- Overhead—Expenses such as rent, utilities, taxes, and insurance are all overhead costs and should be considered when calculating costs.

- Marketing and advertising—Promotional materials and ad campaigns aren’t free and should be included in the cost of the product they promote.

- Packaging—It may seem small, but the packaging materials you use and the labor involved in packaging the products shouldn’t be ignored.

- Labor—This one is pretty obvious, but any wages, benefits, or other expenses associated with the product in question need to be factored into the cost of the product.

- Inventory Shrinkage—Although this one is often overlooked, you should consider including inventory shrinkage when you calculate your cost per unit.

Now that we have a more accurate understanding of our product’s cost, we can use it in our margin and markup formulas.

What is the markup formula?

You can think of markup as the extra percentage you charge your customers (on top of your cost).

The markup formula looks like this:

An example of using the markup formula

Now let’s make the example a little more concrete. Let’s say the cost for one of Archon Optical’s products, Zealot sunglasses, is $18. That $18 is how much it costs Archon Optical to create a single pair of the Zealot. They will then turn around and sell each Zealot for $36.

If we run through that calculation, we arrive at a markup of 100%:

Pricing products based on markup

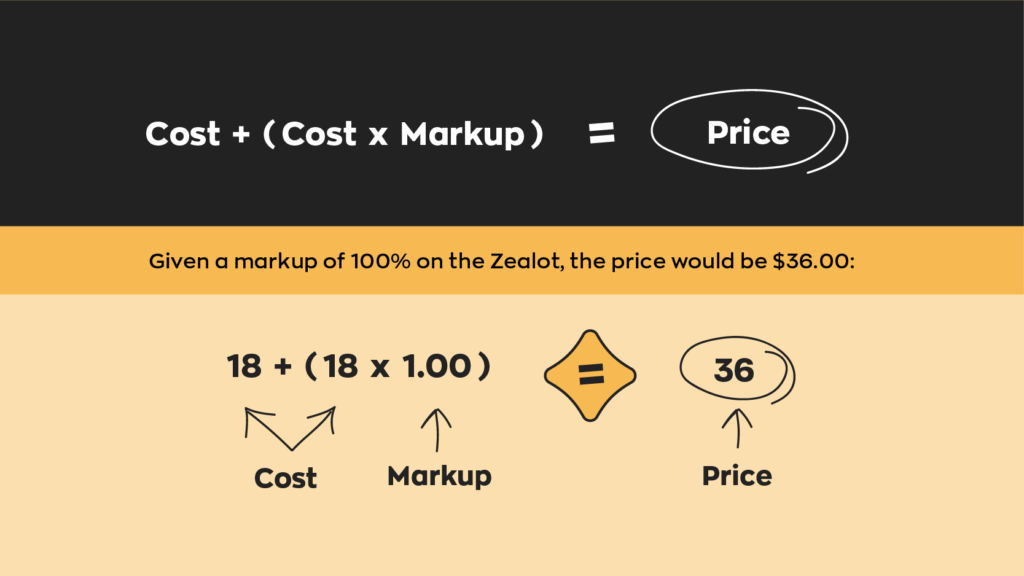

However, some businesses might set their prices based on a specific pre-defined markup percentage. They’d have the costs ready and have particular markup percentages in mind to help them calculate a price.

How would we express the markup formula in this case? Let’s write this out:

Expressing markup as a percentage can be very useful. This way, you can guarantee that you generate a proportional revenue for each item you sell. Even if, down the road, your cost changes or increases. This means the markups you set up at the beginning should scale well as your business grows. We’ll discuss this more when you’ve scrolled further down this page.

What about margin vs. markup?

Now that we’ve defined markup and how it helps you decide on a price, we should discuss the other big M-Word: margin. The type of margin we’re talking about in this case is gross profit margin, which describes the profit that you earn on a product as a percentage of the selling price.

What is the margin formula?

You would often write margin as a specific amount in currency or as a percentage. However, when calculating margin, you always divide by the price.

If we want to use the margin formula for the Zealot sunglasses, here is what that looks like:

When should I use margin vs. markup?

If you’re selling products, the ultimate goal is to turn a profit. Both margin and markup are pricing strategies to ensure you do just that. The decision on which of these two you use depends on your business needs and goals.

Markup is a perfect way to ensure you generate revenue on each sale. Markup is good for getting started because, as you are getting things set up, you are keenly aware of the costs for your business, and you’re still learning about the kind of revenue you can bring in through sales.

As you get to know your business better and you start to look at reports on your sales, margin can help examine how much actual profit you’re making on each sale.

Generally speaking, you would use margin in situations where the cost of production is consistent and stable. Consider using markup instead of margin if you have various products and their costs vary significantly.

No matter which one you choose, there are some downsides to each. Since the cost of a product is often a variable number and can change without warning, if you use margin, you might be pricing your products too low. On the flip side, if you use markup, you may be pricing too high as you constantly adjust for the changing costs. This will prevent you from staying competitive and ultimately result in customers taking their business elsewhere.

How to Convert Margin Into Markup

Now you know how to calculate margin and markup, but what if you don’t have the price and cost of a particular product? What if you only know the markup percentage? Is there a formula to convert markup directly into margin?

The answer is yes, and we’ve written out the formulas below:

- Markup = Margin / (1 – Margin)

- Margin = Markup / (1 + Markup)

In general, we’d recommend that you still know your price and cost as real numbers when examining markup and margin, but if you’re just trying to do quick conversions, these formulas will do the trick.

With the formulas above, you’ll need to express your numbers as a percentage, whether markup or margin. This means you write 100% as 1.00, 200% as 2.00, and so on.

Let’s take the example of a 50% margin and see how to express that value as markup

Markup = Margin / (1 – Margin)

Markup = 0.50 / (1 – 0.50)

Markup = 1.0

Therefore, a margin of 0.50 (50%) means a markup of 1.00 (100%)

Margin vs. markup chart

As you can see, once you have a number for margin in place, it’s straightforward to figure out markup. Since there’s a simple mathematical relationship between the two, you can even keep a cheat sheet with a few values in mind, like the one below:

| Markup | Margin |

| 100% | 50% |

| 200% | 66.6% |

| 300% | 75% |

| 400% | 80% |

| 500% | 83.3% |

You can use the formulas above or this quick margin vs. markup chart to quickly convert margin into markup or express markup as a profit margin.

For a quick demonstration, watch a short video on how to convert margin into markup:

Fixed markup as a percentage or dollar amount

The cost of manufacturing the Zealot may not always stay at $18 (actually, it definitely won’t). Maybe their manufacturing process has changed. Or maybe they’ve expanded and now operate from two different facilities and need more staff to manage the inventory across multiple locations. Whatever the case may be, the wise staff at Archon Optical will want to make sure that they constantly adjust prices to reflect the increase in cost.

This is where the concept of fixed markup comes in handy because it can help you automatically adjust your prices based on changes in cost. You could have cost and price as separate numbers that you input into your inventory spreadsheet or inventory management software, but it’s much easier to have them linked in the long run.

Defining your markup as a percentage above cost ensures that you continue earning sales revenue as costs increase. Still, it also means you don’t have to keep going back to adjust your pricing. Manually adjusting your prices based on cost is plausible for a smaller business, but this quickly becomes untenable as your inventory expands to include hundreds of items.

If the Zealot becomes more expensive to produce over time, the price will have to go up, and gaining a markup of $18 on a $36 item is significantly different from a markup of $18 on an item priced at $55. A fixed markup percentage would ensure that the earnings are always proportional to the price.

What other factors affect markup?

We’ve described markup very simply because we’re assuming a scenario where Archon Optical makes the Zealot for a set cost and sells it at a fixed price, and that’s all there is to it. Of course, real life is a little more complicated than that.

As mentioned in the above section about cost, everything involved with the production and distribution of the Zealot needs to be considered.

If you ship Zealot to customers in boxes or send them in trucks to stores around the city, you need to factor in the cost of freight charges. Depending on the shipping carrier you use, the shipping speed, and whether you add insurance can make those costs vary wildly.

Since the Zealot is a product that Archon Optical had to develop over time (it didn’t just materialize as a completed product), they need to account for all of the time that went into making the Zealot aesthetically pleasing while still blocking as many of the sun’s harsh rays as possible. So product development time can also factor into the cost.

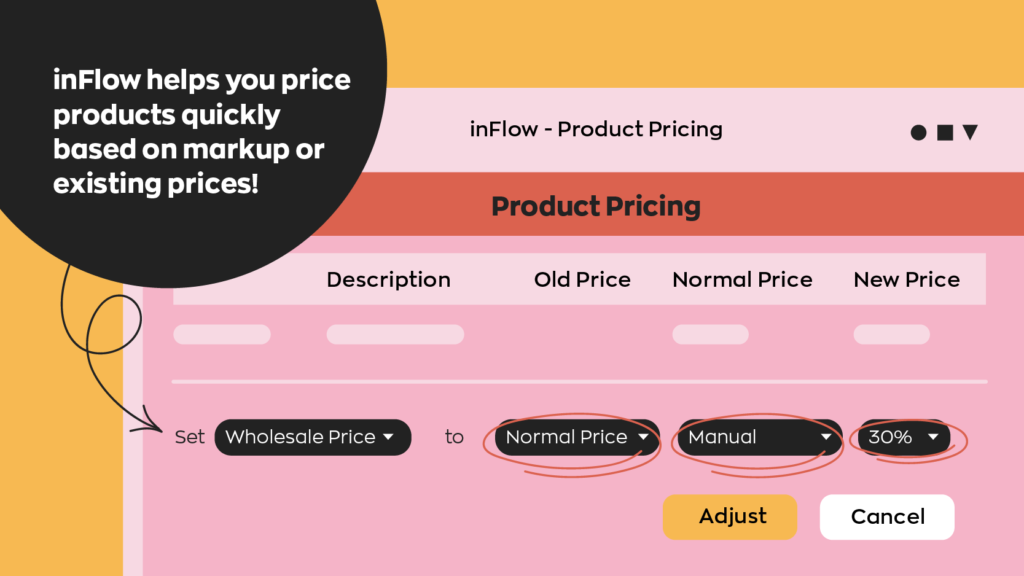

Automate your pricing with fixed markup and inFlow

If your costs change often then you probably spend a lot of time making price adjustments. Our inventory software can help you change prices—and your markup—with just a few clicks. With inFlow you don’t even need to worry about how to calculate margin or markup.

You can set fixed prices for your products, but a fixed markup will always keep your price a consistent percentage above your cost. If you have to update prices on multiple products weekly, this simple feature could save you hours. And you’ll rest easier knowing that your business is making money on each sale, even as your costs change.

But that’s not all—inFlow can help you with many other crucial tasks like setting reorder points and integrating your shipping. You can even set up a complete barcoding system!

To learn more about barcodes and how to set up a barcode system, read our Ultimate Barcoding Guide.

You actually spell out the difference. Can you please do that?

Hi Deborah

Not sure I understand what you’re asking! But, feel free to get in touch with support@inflowinventory.com and we’ll do our best to help you out 🙂

kindly help me convert mark- up into margin.

Thanks

whats the mathematical relationship between mark up and margin

Hi Pyno (and Hellen who asked this before):

I wouldn’t necessarily try converting one thing into the other. Instead, I’d find out the Price and Cost of a particular item, and calculate margin and markup from there. As long as you have those two variables, you can use the formulas in this post to find out either Margin or Markup.

Thanks for your interesting article. If I have a range of products that I wish to receive a particular margin on (and it varies). Is there a formula for calculating the markup % to ga in a given margin.

Ie 50% margin is 100% markup and 40% margin is 80% markup but 20% margin is 25% markup.

What would 42% margin be for instance?

Hi Steve, you’re not the first person to ask this, so this is actually the subject of our latest post: https://www.inflowstaging.com/blog/markup-into-margin-formula/

That formula on that page can help you to find the margin when you only have the markup percentage, or vice versa.

This very useful. Well explained, so simple to understand.

Thank you !

Thomas, this is the best article I’ve read on the topic. You have a knack for teaching! Please keep doing what you’re doing.

Thanks for the kind words and for stopping by, Kiara. I’m glad you found the article helpful!

Well explained….simple and straight forward.

Why would a business not be able to achieve a mark up of 100%

Hi Robyn!

Well if you’re reselling there are definitely some high value items, like laptops and cellphones, where it’s hard to make a markup of 100% because you’re already getting the products at a manufacturer markup, and consumers won’t buy the product for much more than that. In these cases, you can usually sell peripherals with a high markup value to help to make up for the loss in profits on the big ticket items.

Considering the below what would be my selling price.

my expenses are 15% of the current sales and my customer receive a discount on every invoice about 20% (which varies customer by customer). I would like to have a net 15% margin of profits.

should I work my prices based on the above markup formula and how or should I work in the margin formula and how.

for e.g my cost for a product A is 7. what would be my selling price to get 15% net margin with the above details.

Hi Zaheer,

If you’re looking to find out the price and you know the margin and cost, you can use this formula instead:

Price = -Cost / (Margin-1)

In your example, that would be:

Price = -7 / (0.15-1), which is a price of 8.23.

For margin this formula seems to only apply when the margin is less than 100%. What if you have a product you want to sell for more than 100% margin? And what if you want to maintain the margin over time.

For example I have an apple that I buy for $0.68. Today, I sell it for $2.00. If the cost goes up to $1.10 tomorrow and I want to maintain the same margin (not markup) how do I do that?

Hi Adam! I had a colleague on the QA team help with this so that it’s easier to follow the math.

That same formula in the post can apply to the example you’d written out.

Let’s just rearrange the margin formula so it’s (Price – Cost) / Price = Margin.

Using your cost of $0.68 and price of $2.00, that’s a 0.66 margin (66%).

Knowing that, you can rearrange that formula above to solve for X (the new price).

(x – 1.10) / x = 0.66

(x – 1.10) = 0.66x

x – 0.66x = 1.10

0.34x = 1.10

x = 3.24

So $3.24 your new price to preserve a 66% margin on $1.10 cost.

Been confused for years with the margin markup. This is the best explanation ever. I will never forget it again!

Hi,

How do you calculate the mark-up percentage backwards from the GP percentage?

Is there a way to do that?

Hi Sharon, we’ve got a related post about how to turn margin back into markup with a formula table for common values: https://www.inflowstaging.com/blog/markup-into-margin-formula/

I think that post should answer your question!

Can I system auto add product picture at side of item in invoice, or estimate

Hi Jef, sorry, inFlow doesn’t currently add pictures to printed documents/orders.

However I’ve just recorded your feedback with our team and we’ll let you know if we change this in the future!

Thank you

Cheers, Larry!

How do I add 15% margin onto a €10 item

Hi. Is there a formula were you can get a higher percentage of accuracy in your gross profit if you have different mark up? Ex. You have a hundred different types of products and a mark up from 10%-100% in them. How can you get the proper gross profit without a POS system.

Hi ClifftonKim, we don’t have a formula for this specifically, but rather this is the kind of thing an inventory management system like inFlow Inventory can help with. Because our software can track the profit and COGS on every single sale, it’s easy to run a report on exactly how much gross profit you made over a given period of time, and which products contributed to it the most.

Here’s a quick example of the types of reports you can run: https://www.inflowstaging.com/support/cloud/reports-included-inflow-cloud/

We’ve also got a dashboard that shows your Top 5 products, so you can view them without ever having to run a specific report.

i want markup details plz help 1 % markup= ?

2% markup =?

plz helf

Hi Muhammed, sorry, I think there might be a misunderstanding here.

You’ll usually need two out of three numbers, and then you can use them to figure out the third number.

So if you have price and cost, you can figure out the markup.

Or if you have the markup and cost, you can figure out the price.

if is 37% based on selling price what does it mean

Sorry Augusta, I’m not sure what that percentage is referring to. If it’s a % based on the selling price, it sounds like you’re talking about a margin percentage (Margin = (Price-cost)/Price)

What does this mean “if the gross margin of a product was 30%, it could be increased as much as 17% through simply raising the price 5% if the cost is not changed” ? Can you please explain

Thanks a lot to clarifying!

It was really simple and of a great help to my experience.

For the first time in my career life I got the core meaning of a markup and know the difference between it and the margin.

If the cost of an item is $14.97 and I sell it for $35.38, the profit is $20.41.

I have other items with different costs but I want to maintain the same percentage margin as the first item.

The costs of the other items are;

$16.64

$19.92

$22.94

It could be that I’m getting confused between percentage margin and percentage markup.

Thanks,

Hi Darren!

It sounds like you want to keep the *markup* fixed across those items, since the numbers you provided represent the cost.

One easy way to think about it is markup is based on cost, while margin is based on price.

For the example above, if you use the markup formula with a price of $35.38 and a cost of $14.97, you’ll get a markup of 136.34%.

So that means you’re setting the price 136.34% above the cost.

If you’d like to maintain that for the other products, you’d just be adding 136.34% on top of each of their costs.

So $16.64 (16.64 * 1.3634) = $39.33

You can then apply the same math to the other costs you mentioned.

If you really did mean margin, then you can simply convert the markup into margin, and use the margin formula instead. We’ve got another post on how to convert one to the other here: https://www.inflowstaging.com/blog/markup-into-margin-formula/

Hope that helps!

Hi I’m been so confused with the margin… let’s see if I have a room with a TL $238 and the cost of $74 how I can get a margin

By definition, the markup percentage calculation is cost X markup percentage. Then add that to the original unit cost to arrive at the sales price. The markup equation or markup formula is given below in several different formats.

im business student but ive been usually confusing btwn margin and markup thanks a lot

Great experience

I understand every thing

Hello Thomas –

How would one calculate the cost of a partner program if the program gives guaranteed margin based upon type of sale – New bus, renewal, upsell/cross-sell? I only have total contract value, so what the value of the PO was, which is reflective of the discount we gave to the partner when we sold it. I have no idea what the discount was and I’ve been wracking my brain trying to figure out how to model the program. Any help would be appreciated.

Very clear and explanatory

Thanks.

if you have more notes about mark up and margin effect on financial reported

Sorry issayas, this post is just about the calculations for now. But we’ll consider that for the future.

This was very helpful! Thank you!

Hi, we have a distributor who says he needs to make 30 points on selling our product and that his retailers also will want 30 points

Our selling price to the distributor is $6k, therefore is he saying he expects $1,800

What I do not understand is who is on the hook for the retailers margin and how it is calculated

Hi Anne, that’s a good question, but unfortunately it’s not one that I have a good answer to right now.

I don’t want to mislead you with my own lack of experience with retailer vs. distributor relations here.

For something like this, you might have some better luck on our Facebook Community or Quora because you can get really specific about questions and get answers from other business owners who have had similar experiences.

Hello Thomas,

I came across this article and have a few questions. You mentioned labor costs and shipping costs in the article. How would you go about factoring these costs into the final pricing of a product being distributed and not manufactured.

Hi Robert,

Our software, inFlow Inventory, actually allows you to bake freight and service costs into your product cost. So the amount you paid for shipping and any extra services from the vendor on that purchase order (PO) can be applied to the cost of the products you purchased on a PO.

We’ve got an article here that breaks down how our software does that math on a simple PO with three products: https://www.inflowstaging.com/support/cloud/inflow-cloud-calculate-cost-item-cost-goods-sold/

how to you calculate a cost price and selling price if you know the gross margin

Hi Nao, you’d need to know at least two numbers in order to calculate the third number.

So in order to calculate the cost, you’d need the price and the margin. Or the margin and the cost in order to calculate the price.

Discuss the circumstances that require a conversion of “mark-up” to “margin” or vice

versa

Amazing information. I have a quick question though. Are markup and margin are the same? I understand that markup is the percentage of the profit you’ll make and the margin is how much you need to top up on top of your cost to get a profitable selling price (correct me if I’m wrong) But in a lot of cases when we convert margin to the markup or vice versa they just seem to be the same. Let us say you get a question in a quiz “which I did” saying is margin and markup are the same? In some cases, it is a yes and in other cases, it is a no, but I do want a specific answer as to why people confuse them on being the same or different. Thanks!

Hi Ayesam,

They both use the same sets of numbers, but markup is based on cost, and margin is based on price.

So I think it’s mainly about framing that perspective.

Amazing explanation thank you so much!!!!

Are there any unusual circumstances that the rate of markup is equal to the gross profit margin?

Thanks!

You have “Pricing products based on markup” but not “Pricing products based on margin”, would be good addition for consistency

Can inFlow interface with QuickBooks?

Hi Michelle, yes! We integrate with QuickBooks Online specifically. You can learn a bit more about that here: https://www.inflowstaging.com/features/integrations

Hi guys can someone help me solve this problem urgently.

Below are the costs to source and sell a laptop cooling pad on Amazon.

1. Purchase cost – 7.49€

2. Ocean freight – 1.03€

3. Amazon commission – 15% of selling price

4. Order fulfilment fees – 3.99€

5. Storage fees – 0.15€

6. Average PPC (advertising) spend – 8% of selling price

7. VAT – 20%. The selling price should be inclusive of VAT. For example if the VAT inclusive price of a product is 120€, the customer pays 120€ which includes the 20% VAT 20€. Net proceeds for the seller will be 100€.

Calculate

1. the ideal price to meet target margins of 18-22% and,

2. the breakeven price

Which formula is best to use when trying to calculate the cost of goods sold ( Part 3, Schedule C) of the 1040 tax form?

Hey Mittie,

Thanks for reading. I’m not sure either of these formulas would be ideal for calculating cost of goods sold (COGS). You can calculate COGS by first figuring out the cost of your inventory at the beginning of the year. Then add up all the costs you incurred throughout the year like storage fees, administration, purchases, shipping, etc. Now take those two numbers, add them up and subtract your end of the year inventory costs and you’ll have your COGS. Here is an example to help illustrate:

I spent $20,000 on inventory at the beginning of the year. My storage fees were $500, administrative fees were $250, and I spent $250 on shipping and handling. At the end of the year I still have $10,000 worth of inventory on hand. For this example the COGS would be 20,000 + 500 + 250 + 250 – 10,000 = 11,000.

Hope this helps. We have a COGS article releasing in the coming months that will go into everything in more detail, so be sure to come back and check it out!

Cheers,

Jared

Thank you for sharing such a great article. It really is helpful and I enjoyed it. Thank you again!

Hey Francky,

I’m glad you enjoyed the article and got some value from it. That’s what we aim for here at inFlow!

Cheers,

Jared

Thank you. You’ve well explained the difference between markup and margin.

What I understood is that mark-up is the true and ideal way of calculating the profit? However, mostly business use margin formula to calculate profit and that’s shown in audit reports.

Can you please confirm that mar-up is the best way?

Regards,

Hamza

Hi Hamza,

We’re glad we could help! As far as your question goes we can’t say for sure that one is better than the other. It’s all about the situation. We find most small businesses just starting out are better off using markup as it ensures you are generating revenue on every sale. Once you’ve got a handle on everything margin is useful when looking at reports to see how much actual profit you’re making.

Hope this helps,

Jared

This so helpful, Thank you for such great examples.

Hi Nthabiseng,

Thanks so much for reading. We’re glad we could help you out!

Cheers,

Jared

If a company purchases a product from a manufacturer and sells that product installed to its customers, should a product which costs the company twice as much as another product be marked up at the same rate?

(cost of installation and administrative processing remains the same for both products)

Thank you

Hey Shawn,

Thanks for reading! To answer your question, yes, it should be marked up at the same rate. Using the margin and markup formula is all about getting the desired profit margin. So if a product costs twice as much, you’ll need to markup that product accordingly in order to get the same profit margin as a product that is half the cost.

I hope this helps!

Cheers,

Jared

I really wanted to thank you for these marvelous educational tips you are showing at this website. My extensive internet investigation has at the end of the day been recognized with awesome facts to talk about with my friends. I feel lucky to have come across the website and look forward to spend more excellent reading time here. Thanks a lot once again for all the details.

Hey Elwood,

We can’t thank you enough for all the kind words! We aim to help, educate, and entertain (hopefully). Please consider signing up to our mailing list at the bottom of this article to get email updates whenever we post a new blog. We hope to see you around 🙂

Cheers,

Jared

This blog is full of great ideas and I’m so inspired by it!

Hey ilan,

That’s so kind of you to say! We aim to please around here 🙂 We’re always releasing new content so please consider subscribing to our mailing list to stay up to date!

Cheers,

Jared

margin call Thank you !

Thanks for the article. Thank you for the help and your work.

Thanks for the information , it is very helpfull

Hey Houston,

Thanks for reading! Glad we could help.

Cheers,

Jared

I express my gratitude for sharing this outstanding article. It has proven to be highly beneficial and enjoyable. Thank you once again!

Hey ulum,

Thanks so much for taking the time to read our blog! We’re glad you enjoyed it 🙂

Cheers,

Jared