Key takeaways

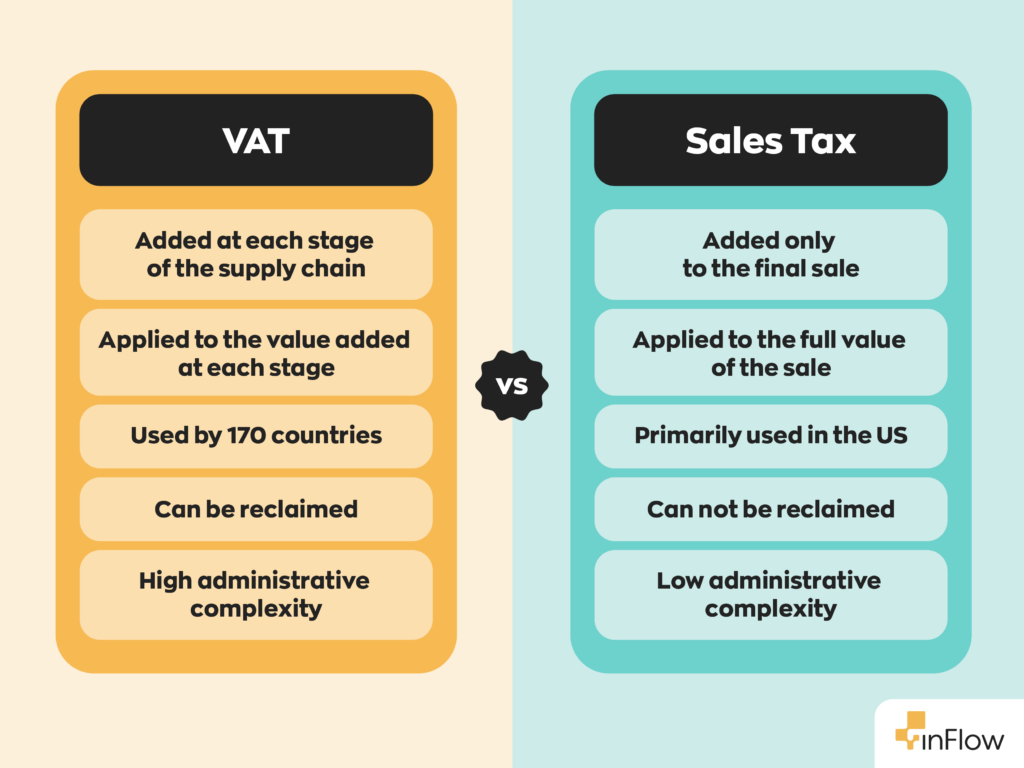

- VAT (Value-Added Tax) is a consumption tax applied at each stage of the supply chain, where value is added to a product or service.

- A VAT number is a unique identifier required for businesses in countries with VAT systems. These numbers enable businesses to charge, collect, and reclaim VAT.

- Businesses operating in VAT-collecting countries may need to register based on turnover thresholds, imports, or the type of goods/services offered, including digital products.

- Unlike a sales tax, businesses collect VAT at every stage of production and allow them to reclaim VAT on purchases.

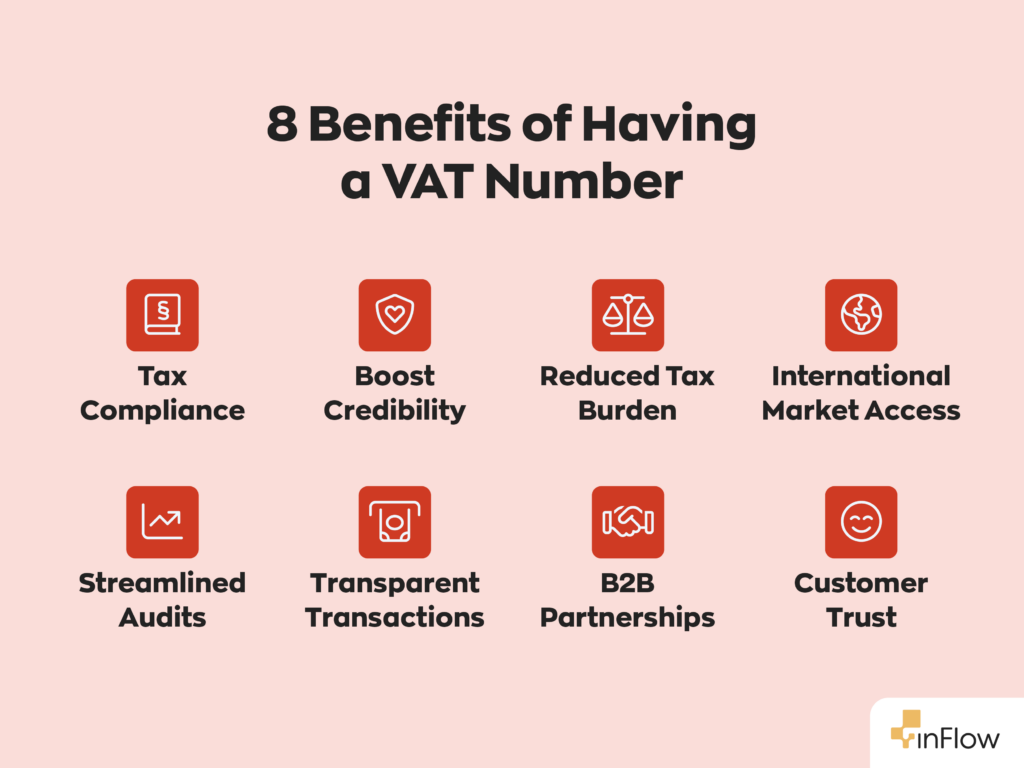

- Not only does a VAT number ensure your business is compliant, but it also enhances your credibility. VAT numbers also make it possible for businesses to reclaim VATs paid, which will reduce their tax burden.

- Over 170 countries, including the EU, Canada, and Australia, use VAT systems with varying rates and regulations.

- The average VAT rate is 21.6%. Some countries apply rates as high as 25% and others as low as 5%.

Most businesses operate with a central goal: to make money. But growing revenue isn’t easy, especially when you’re confined to a specific region. After all, you can only convert so many people locally before your sales eventually reach a plateau. A common way to overcome this hurdle is by expanding your operations across international borders.

While international business can be a powerful way to boost your reach and revenue, it comes with a slew of complications to consider. One significant aspect is compliance with international tax laws, including obtaining a VAT (Value-Added Tax) number. So, what is a VAT number? Why might your business need one? And how does it differ from other tax identification numbers?

What is a VAT number?

If you’re a business, particularly in the EU, looking to sell your goods across borders, you’ll need to know what a VAT ID is. A value-added tax identification (VAT) is an identifier businesses use for tax purposes in countries that collect Value-Added Tax. It allows businesses to charge, collect, and remit VATs to the relevant tax authorities.

VAT numbers are commonly required in the European Union (EU) and many other countries where VAT is a standard tax. VAT IDs can consist of up to twelve characters and can contain both numbers and letters. Many countries will have their own suffix to make identification easier, for instance, DE for Germany and FR for France.

This is distinctly different from a country like the US, which does not have a VAT system. Instead, they use a sales tax system, and businesses use identifiers like the Employer Identification Number (EIN). Other countries, such as India, use a Goods and Services Tax Identification Number (GSTIN). This number serves a similar purpose as a VAT number.

What is a Value-Added Tax?

As we mentioned above, VAT number stands for value-added tax number. Some also refer to it as a value-added tax identification number. It’s a consumption tax that VAT nations apply at each stage of the supply chain where value is added to a product or service.

Unlike a sales tax, which is only collected on the final sale of a product, VATs are collected throughout every stage of production and distribution. However, you only add VAT on the value added at each stage, not the entire transaction value.

For example, let’s say you’re a manufacturer out of the UK, and one of your wholesale clients is from Portugal. When you make a sale to that client you would charge VAT on the sale. The wholesaler would then be able to reclaim the VAT paid on that sale once they sell the goods to a retailer, and the retailer can reclaim the VAT once sold to the consumer. While each member of the supply chain pays the tax, the end tax burden ultimately falls on the consumer.

The overall goal of VAT is to increase a country’s tax revenue without unfairly taxing higher income individuals. The system aims to tax consumption rather than income, which means people contribute based on their spending habits.

What countries collect VAT?

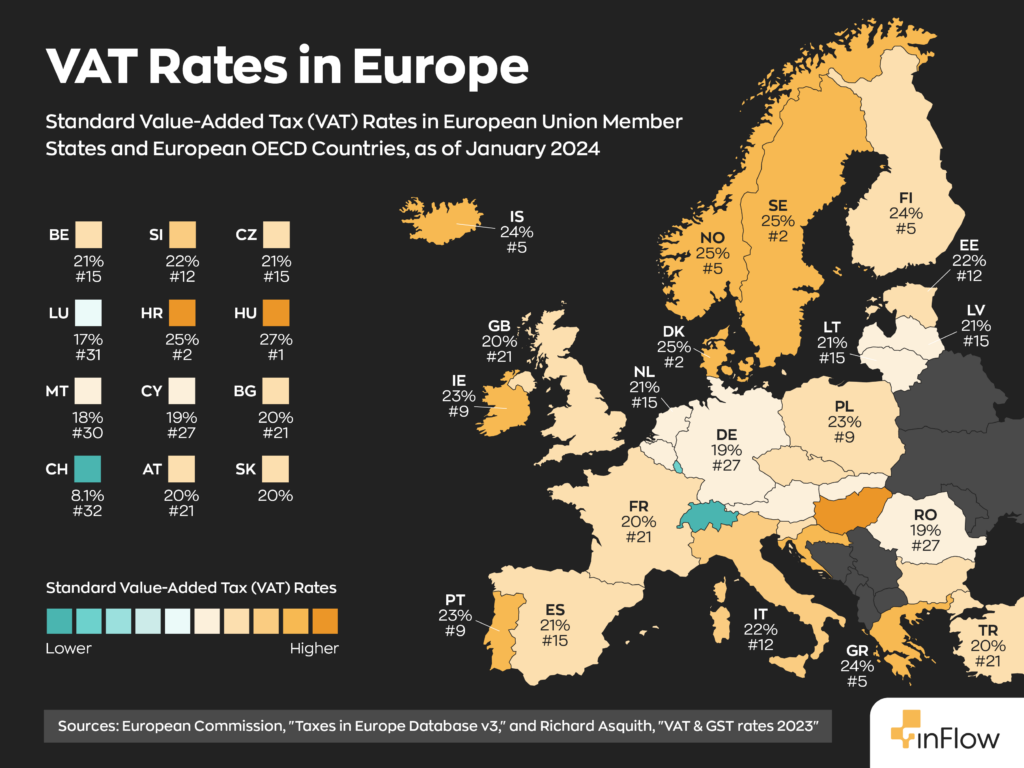

At the time of writing, more than 170 countries currently collect VAT. This includes most countries that are part of the EU, Canada (where it’s combined with GST in some provinces), and Australia. Though their individual collection numbers tend to differ, the average VAT is 21.6%, but these rates can vary wildly from country to country.

For instance, Germany applies a VAT of 19% while Sweden adds 25%, and some countries such as Canada have rates as low as 5%. Comparatively, the average combined state and local sales taxes in the US come in at just over 6%.

Does your business need a VAT number?

The idea that only large companies need a VAT number is a common misconception. In truth, if your business operates in a VAT-collecting country, you may need to register for a VAT number, depending on the country’s regulations.

For example, in the UK, businesses only require registration past a certain annual turnover threshold. Some EU countries even have a tax relief scheme for businesses with low turnover, exempting them from VAT payments while still requiring registration.

Something important to note is that Value-Added Tax doesn’t only apply to physical goods. You’ll also need to factor it in for any services, such as digital products or consulting. Therefore, businesses that offer these services across borders may also need to register for a VAT number.

While the general rules and regulations of VAT are similar across borders, each country’s process tends to differ slightly. Remember, this is a legal obligation. It’s important to remain in compliance, especially if you’re a foreigner doing business across borders.

An often overlooked part of having a VAT number is that it’s a sign of trust. Operating across borders requires building and maintaining relationships with the locals in order to maintain supply lines. Not having a VAT number is the first sign that something might be amiss, and it may prove a hindrance. Even if you don’t strictly need a VAT number, it may be best to register for one anyway.

How do you register for a VAT number?

The process of registering for a VAT number varies from country to country but generally follows a similar structure. Here are some of the typical steps you would need to take when applying for a VAT ID number:

- Determine the appropriate tax authority: Each country has its own regulatory body for VAT. For example, the UK uses HM Revenue and Customs (HMRC), while Ireland uses the Revenue Online Service (ROS).

- Gather Required Documentation: This may include a national insurance number, a unique taxpayer reference (UTR), and detailed business data such as revenue, turnover, and projected revenue.

- Complete the Registration Process: Depending on the country, you may be able to register online, via post, or through an authorized agent. However you choose to apply, ensure you submit all required documents accurately to avoid delays.

Keep in mind that VAT is a requirement regardless of whether you have a VAT number or not. If you register late, you’ll need to go back through your records and retroactively pay the total you owe, including any penalties you may have incurred.

How inFlow Inventory Can Help with VATs

Adhering to VAT compliance is no easy feat. But luckily our software inFlow can make it much more manageable. inFlow streamlines your inventory management processes while helping you track and organize tax requirements like VAT. With inFlow, you can:

- Automatically calculate VAT on transactions.

- Easily generate tax-inclusive pricing schemes on sales orders.

- Save a specific taxing scheme and pricing scheme to a customer record.

- Manage multi-country inventory and tax reporting with ease.

Additionally, inFlow has everything you would expect from a complete inventory management system, including barcodes, reorder points, and real-time inventory tracking.

Conclusion

If your business operates out of the EU or any of the other 170 VAT countries, obtaining a VAT number is essential. Whether you’re selling physical goods or offering digital services, understanding VAT regulations is key to not only avoiding penalties but also building trust in international markets. While the process can seem daunting initially, you can start in no time with just a bit of research and preparation.

0 Comments