Key takeaways

- Job order costing is an accounting methodology manufacturers use to evaluate the exact cost of each custom order, including materials, labor, and overhead.

- This accounting methodology works best for businesses that deal with unique and custom products.

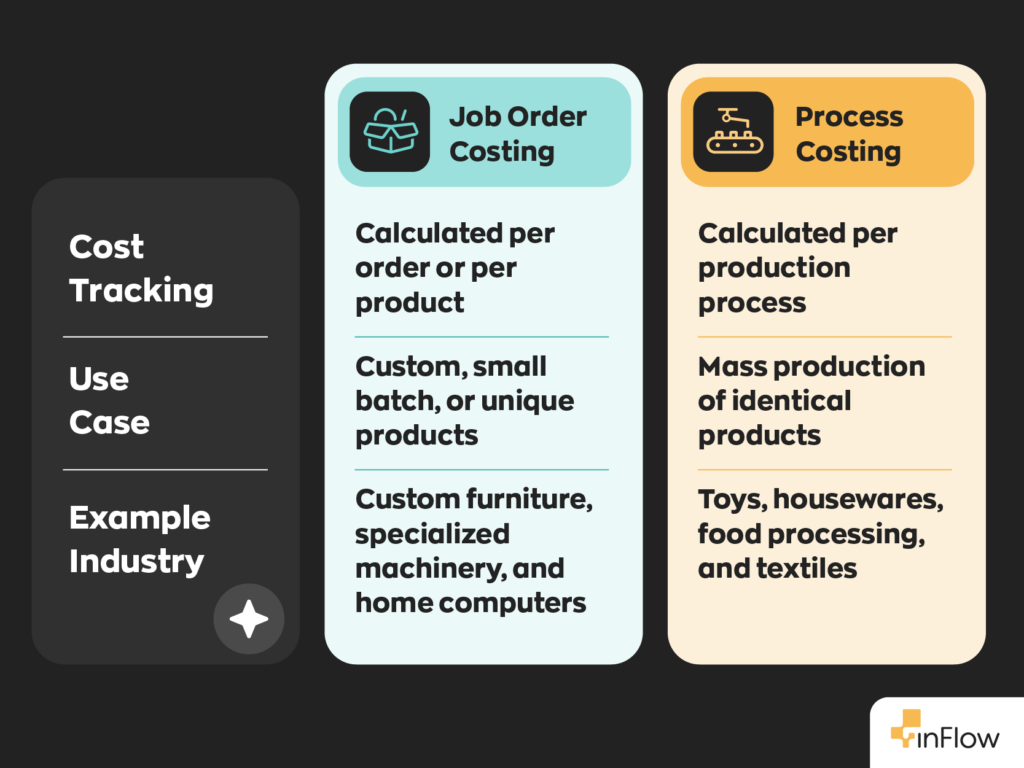

- Job order costing differs from process costing, which spreads costs over large batches.

- Manufacturers who use a job order costing system have better cost control, budgeting, and pricing accuracy, which allows them to determine profitability and adjust pricing strategies.

- Proper implementation requires detailed tracking of direct materials, labor, and overhead expenses to ensure accurate cost calculations.

- Some common challenges include complex record-keeping, fluctuating costs, and the need for precise tracking.

- Companies that adopt manufacturing software are more likely to succeed with a job order costing system.

Calculating costs for any manufacturing business requires meticulous tracking. There’s labor, raw materials, utilities, shipping; the list goes on. However, for manufacturers that deal with custom or unique orders, cost tracking can be ten times more challenging.

With custom products, different orders incur different costs, and that makes accounting for production costs difficult. And that’s not great for any business. One accounting method that these businesses use to make things more manageable is job order costing.

Today, we will discuss job order costing in detail, including its definition, whether it’s right for you, and how to implement it in your manufacturing or assembly business.

What is job order costing?

Job order costing, or job order cost accounting, is an accounting method that calculates the exact rate of each product assembled. As mentioned above, it’s especially useful for businesses that produce custom products or small batch production runs.

This is distinctly different from process costing, which averages costs over large batches of identical products. Job order costing makes tracking direct labor and overhead expenses easier for individual projects, offering more precise cost control and pricing accuracy.

What are the benefits of job order costing?

Think of all the mass-produced products you see on retailers’ shelves. On a microscopic level, there might be slight differences, but they’re generally identical. These products are an example of process costing, which offers tremendous advantages to manufacturers. Perhaps most notably, it makes calculating total manufacturing costs simple.

That’s not the case for manufacturers who take custom orders. It’s reasonable to say that each of their orders will be different in some way. That means each will cost a different amount to produce. Here are some of the most notable strategic advantages job order costing offers businesses:

- Cost control and budgeting—By tracking each product’s costs in detail, you can control expenses and quickly identify inefficiencies, making it easier to determine pricing strategies.

- Profitability analysis —Job order costing allows manufacturers to determine the profitability of each order. From there, you can adjust pricing or resource allocation accordingly.

- Pricing accuracy—When you know exactly how much each product costs to manufacture, you can set prices that reflect the actual value and ensure sustainable margins.

- Customization efficiency—For businesses that handle assemble-to-order (ATO) or made-to-order manufacturing, job order costing is invaluable in accurately estimating costs and delivery timelines.

Components of a job order costing system

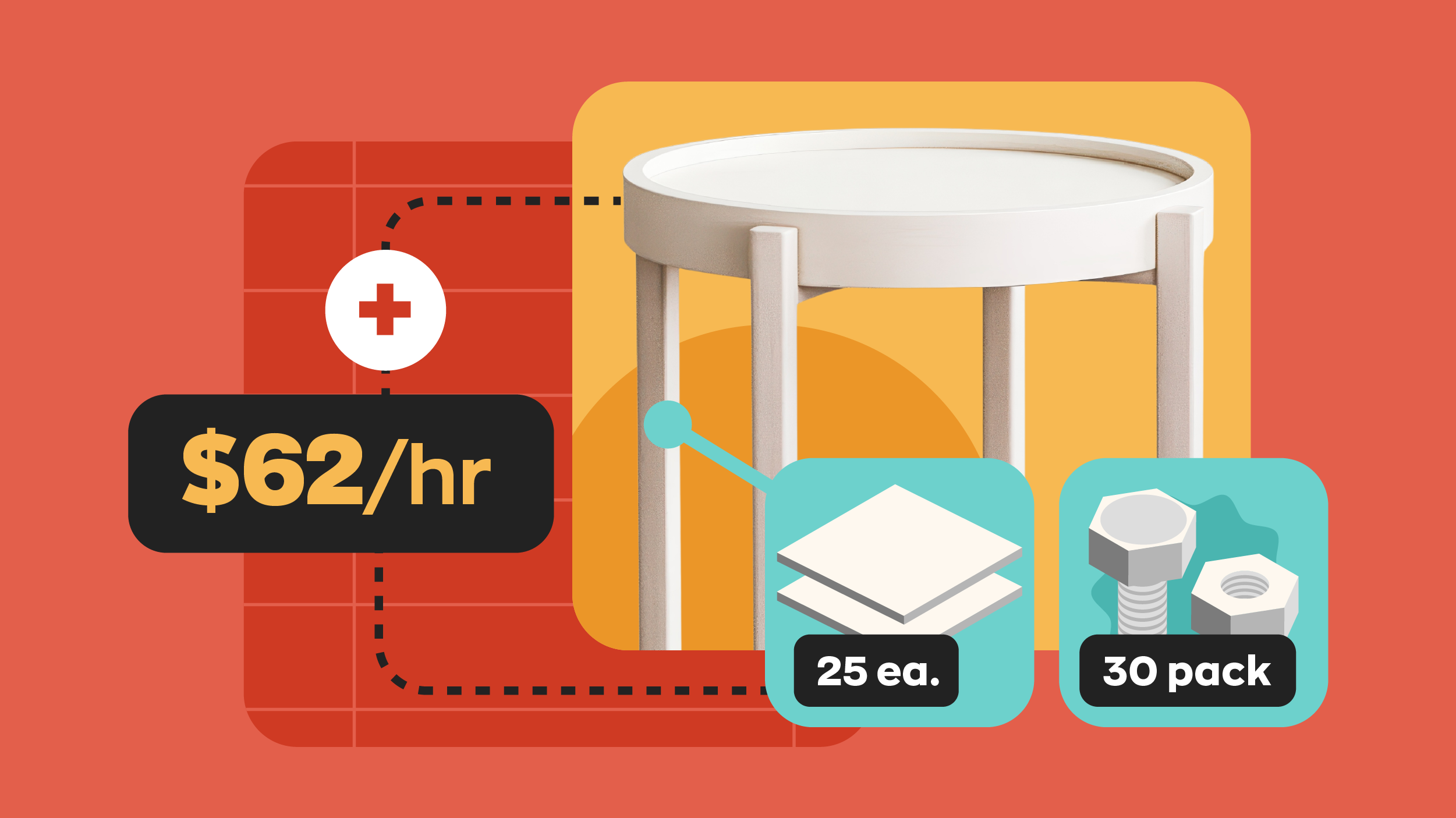

Job order costing aims to track three main components to accurately calculate each product’s cost. Those components are:

1. Direct materials

Direct materials are the raw materials used to create finished products. With a job order costing system, materials are allocated specifically to each production run. This method makes proper inventory tracking essential.

2. Direct labor

Like direct materials, labor is also assigned on a per-production-run basis. This method is much more manageable since production cycles tend to be much smaller in scale with job order costing. Still, it’s a good idea to log labor hours to understand the labor needed to manufacture each product accurately.

3. Overhead costs

Overhead costs include rent, utilities, insurance, and any other operational costs. To get an accurate understanding of costing, you’ll need to add up all of these expenses and determine a predetermined overhead rate to apply to your products.

How do you start job order costing?

Job order costing systems involve meticulously tracking everything and remaining agile enough to pivot at a moment’s notice. Here are four steps to start:

- Step#1: Define the project—Odd as it sounds, defining the project is an important step that some overlook. Because orders differ, it’s essential to treat each one as a separate project. That means defining the scope of the project and starting anew whenever necessary.

- Step #2: List and track direct materials—Manufacturers rely on a supply of materials to do their jobs. They need to purchase those materials, which invariably incur a cost. Figuring out what materials you’ll need beforehand—and keeping careful track during the process—is crucial for job order costing.

- Step #3: Calculate labor costs—Labor is another cost to consider. Employees work for wages, after all. All things considered, calculating labor costs is fairly simple, especially if your employees work for an hourly wage. However, keep in mind that some projects may require multiple skill sets. That often means a difference in wages. It’s important to factor in the different values.

- Step #4: Factor in overhead—It’s essential to establish a consistent method to distribute your overhead costs evenly throughout each of your products. This may mean figuring out how much your overhead costs per hour of production.

Common challenges

Useful as job order costing is, it has its challenges. Here are some of the most common ones.

Requires complex, in-depth records

Sometimes, storing and displaying information in a cohesive, legible fashion can be complicated. Job order costing requires meticulous records to reach an accurate figure, and keeping and maintaining these records can prove difficult.

Cost fluctuations

Unfortunately, nothing stays the same price. It might go up or down, but either way, it’s changing. That means the cost changes with it. This can be due to seasonal demand or something else.

For example, the COVID-19 pandemic and subsequent lockdown had a major impact affected global markets. It completely broke some while propelling others to new heights. For example, the video game industry saw a 63% annual increase in some areas.

Requires accurate tracking

In addition to requiring meticulous records, job order costing also needs accurate tracking. Not accounting for materials or labor hours throws all the calculations off. While tricky, there’s also some good news here. Manufacturing software can take care of the tracking while also helping out on the reporting side.

Choose what’s best for your manufacturing business

Every manufacturing and assembly business is different. Each has its own specific needs that hinge on the type of products they produce. The trick is to find out what works best for your specific situation. So, don’t be afraid to try something new and test what works best.

If you’re looking to integrate job order costing into your business, start by exploring inFlow Manufacturing and discover how it can help you track inputs and outputs with ease.

0 Comments