How to set up tax/VAT inclusive pricing in inFlow

In regions where prices include tax, additional setup is required compared to inFlow’s default tax feature, which charges taxes on top of the order subtotal. Learn more below.

Web

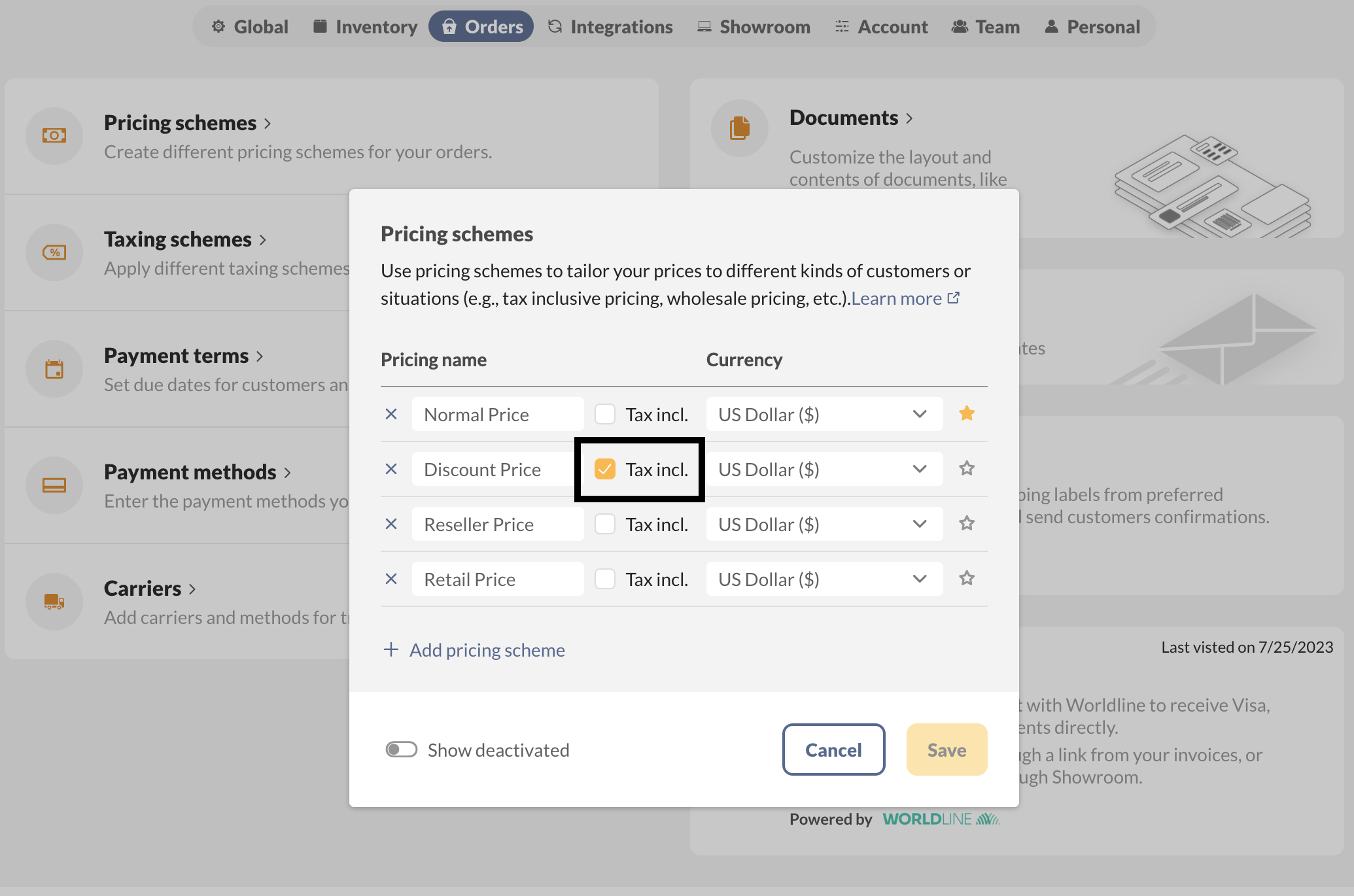

Making pricing schemes tax-inclusive

The tax-inclusive setting is applied to the pricing scheme.

- Go to the Order settings in inFlow (Main Menu>Options>Orders.)

- Select Pricing schemes.

- Put a checkmark on the Tax incl setting for the desired pricing scheme.

- Click Save when done.

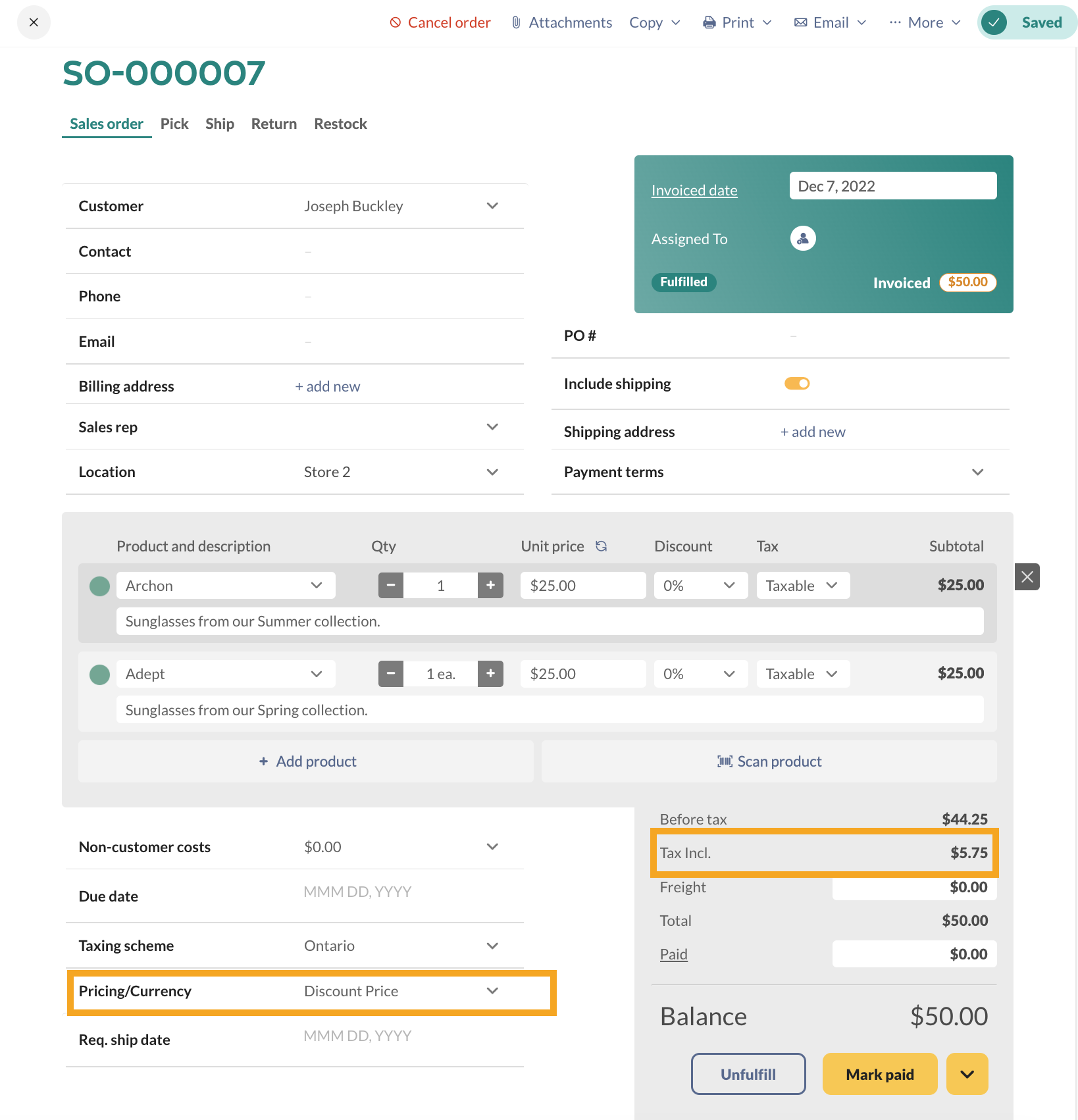

Tax-inclusive pricing schemes on sales orders

When you create a sales order, choose what taxing scheme to apply to the order and the tax-inclusive pricing scheme.

Since prices include tax already, when you choose the taxing scheme, inFlow will calculate and display the subtotal before tax and the amount of tax on the order.

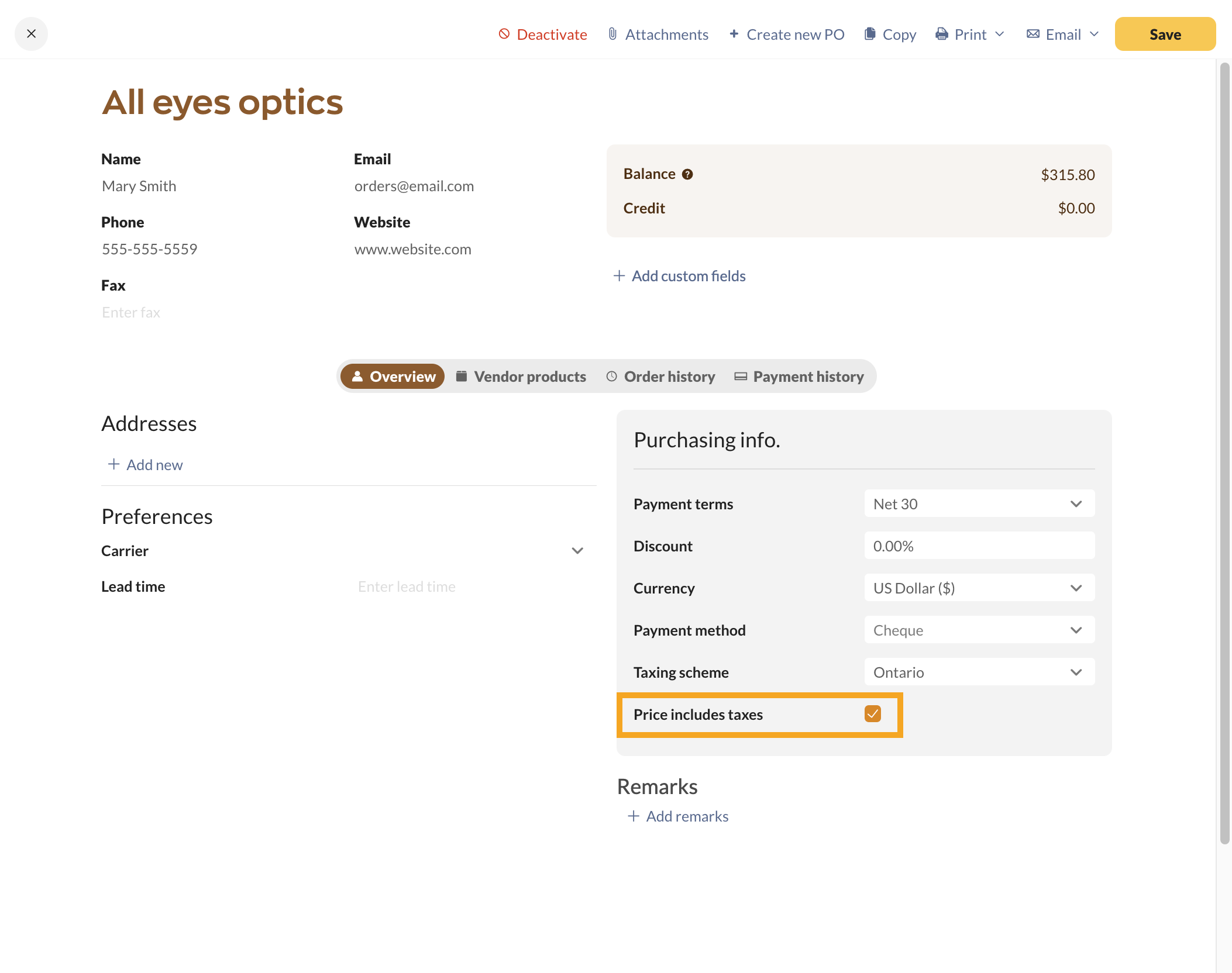

You can also save a specific taxing scheme and pricing scheme to a customer record. This will save you the trouble of having to select it every time if certain customers always require the same settings.

Vendor pricing settings

Do your vendors’ prices also include tax? If so, on the vendor record, place a checkmark on the Price includes taxes setting.

Windows

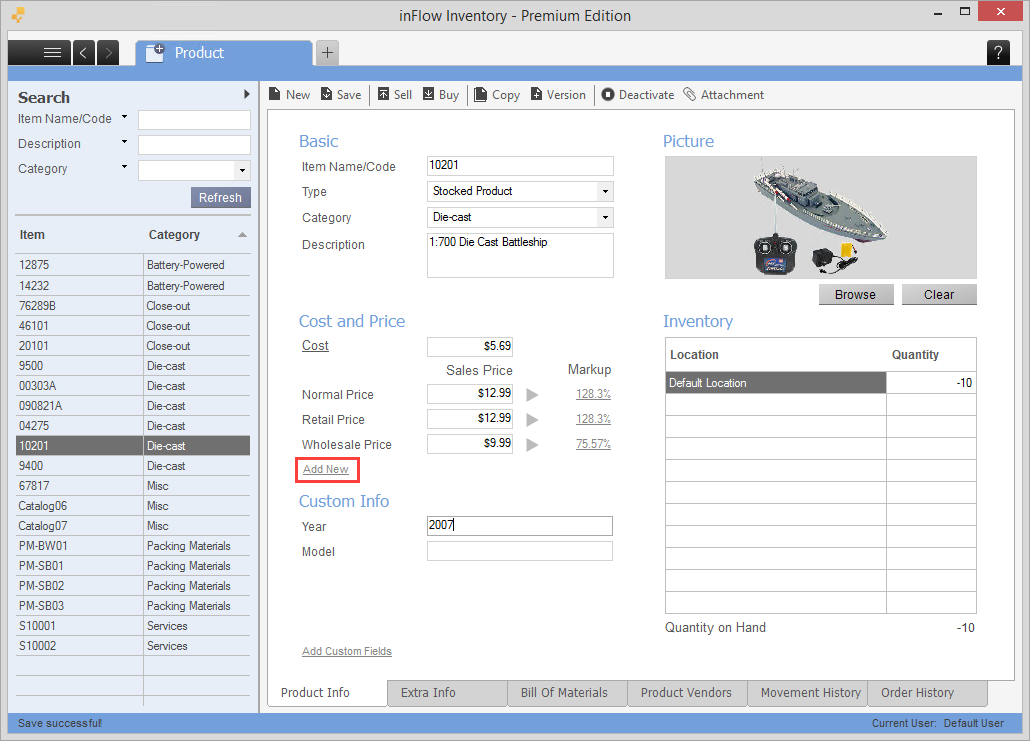

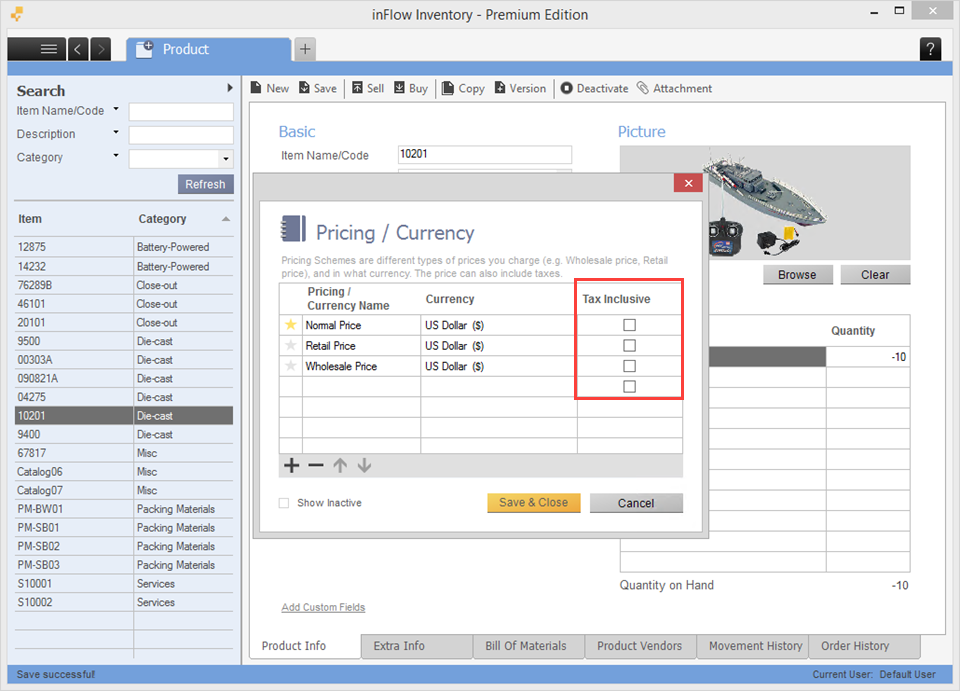

Making pricing schemes tax-inclusive

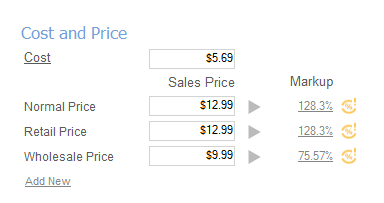

The tax-inclusive setting is applied to the Pricing Scheme, so you’ll have to go to the product page to set this up. To make a pricing scheme tax-inclusive, you can select Add New on the product page under Cost and Price.

Check off any pricing schemes that you’d like to use tax-inclusive pricing. For example, it’s possible to have different pricing schemes based on different locations around the world (e.g., US and UK), and only some of those use tax-included pricing :

Click Save & Close. inFlow will now show a yellow icon beside any pricing schemes using tax-inclusive pricing:

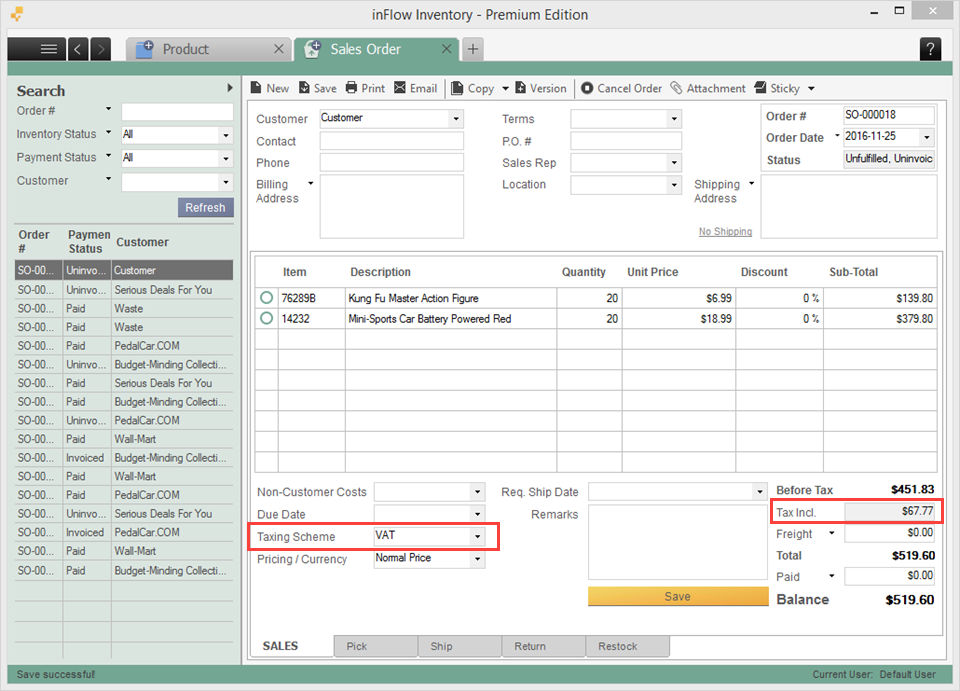

Tax-inclusive pricing schemes on sales orders

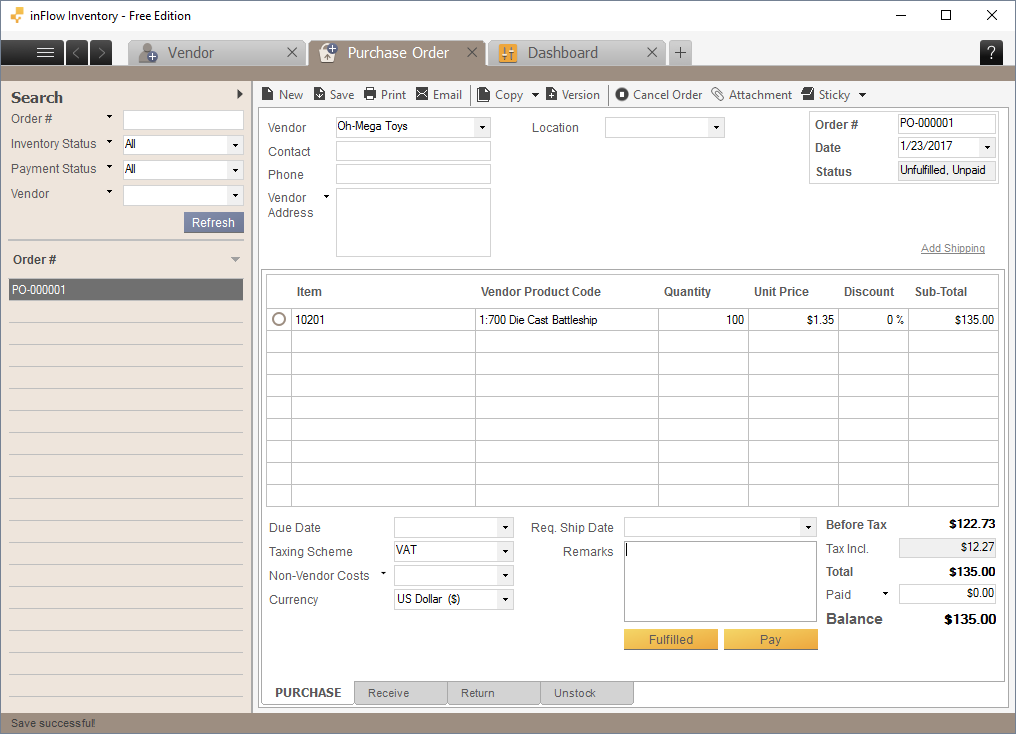

When you create a sales order, choose what taxing scheme to apply to the order and the tax-inclusive pricing scheme.

Since prices include tax already, when you choose the taxing scheme, inFlow will calculate and display the subtotal before tax and the amount of tax on the order.

You can also save a specific taxing scheme and pricing scheme to a customer record. This will save you the trouble of having to select it every time if certain customers always require the same settings.

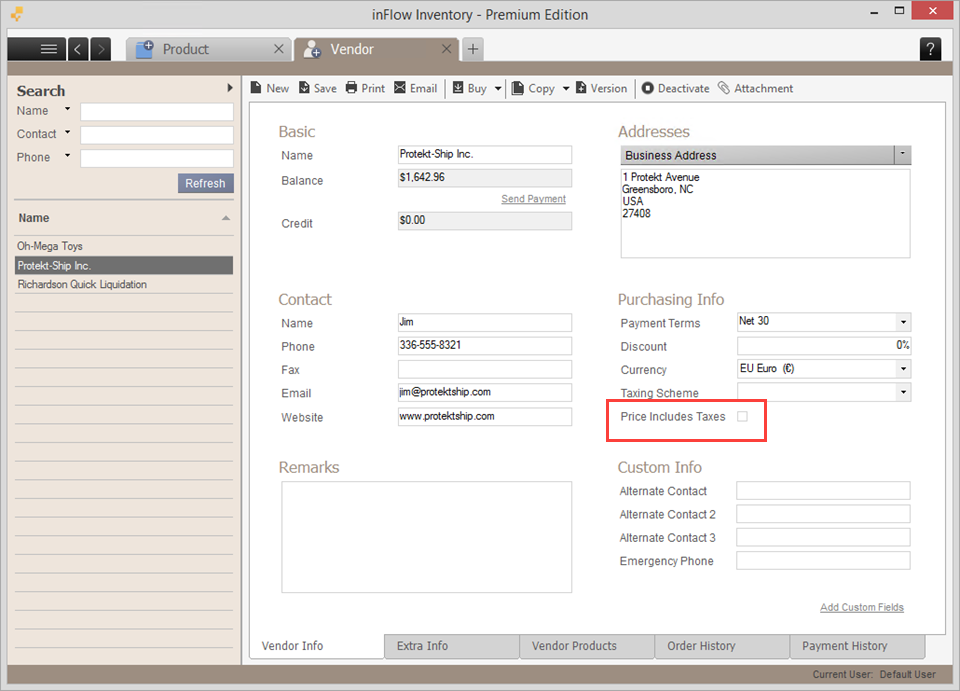

Vendor pricing settings

Do your vendors’ prices also include tax? Here’s how to indicate that your vendor prices are tax-inclusive as well.

From the vendor record, check Price Includes Taxes.

You’ll also want to select the Taxing Scheme that is included in the prices. This way, inFlow will show the total tax at the bottom of the order:

0 Comments